FCPO - Trend Still Positive

rhboskres

Publish date: Wed, 13 Nov 2019, 05:13 PM

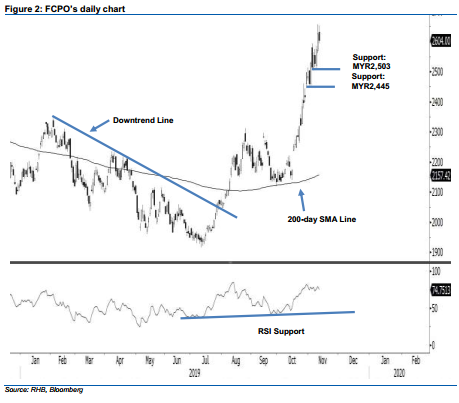

Maintain long positions as there is no price exhaustion signal. The FCPO ended the latest session weak. At the closing, the soft commodity settled MYR23 lower at MYR2,604. Trading ranged between MYR2,594 and MYR2,653. While the negative session came on the back on an overbought RSI reading, at this juncture, it is still not sufficient to lead us to conclude that the commodity’s multi-month upward move is due for a correction. Further negative price actions are needed in the coming sessions to confirm this condition. Additionally, we also take comfort from the fact that the 200-day SMA line is still moving upward. Maintain our positive trading bias.

In the absence of a price exhaustion signal, traders are recommended to remain in long positions. These were initiated at MYR2,175, the closing level of 9 Sep. To manage risks, a stop-loss can now be placed below MYR2,503.

The immediate support is set at MYR2,503, the low of 6 Nov. This is followed by MYR2,445, the low of 30 Oct. Conversely, the immediate resistance is pegged at MYR2,683, the high of 20 Nov 2017, followed by MYR2,758, the high of 16 Nov 2017.

Source: RHB Securities Research - 13 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024