Hang Seng Index Futures - Charts Another Black Candle

rhboskres

Publish date: Mon, 18 Nov 2019, 10:33 AM

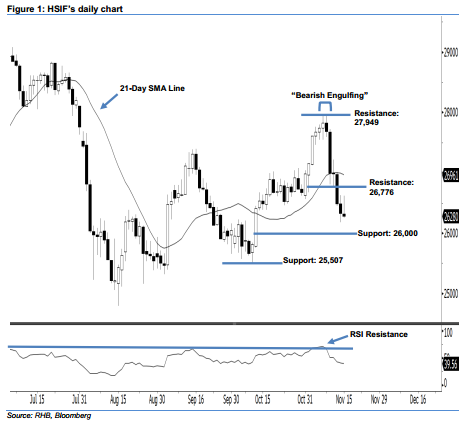

Bearish sentiment remains unchanged, stay short. The HSIF formed a negative candle with a long upper shadow last Friday, signalling that the buyers had failed to reverse the bearish sentiment. During the intraday session, it surged to a high of 26,617 pts before pushing down to 26,280 pts at the end of the day. This is a sign that the selling momentum has not diminished. Technically speaking, the long upper shadow of the candle illustrated the market’s rejection of higher price levels, reflecting that the downward pressure remains intact. This also implies that the outlook remains bearish.

Based on the daily chart, the immediate resistance level is maintained at 26,776 pts, which is set near the midpoint of 13 Nov’s long black candle. The next resistance will likely be at 27,949 pts – this was determined from the high of 8 Nov’s “Bearish Engulfing” pattern. Towards the downside, we are eyeing the near-term support level at the 26,000-pt psychological spot. This is followed by 25,507 pts, which was the previous low of 10 Oct.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 27,400-pt level on 12 Nov. A trailing-stop can be set above the 26,776-pt mark to secure part of the gains.

Source: RHB Securities Research - 18 Nov 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024