Hang Seng Index Futures - Stick to Short Positions

rhboskres

Publish date: Mon, 09 Dec 2019, 05:50 PM

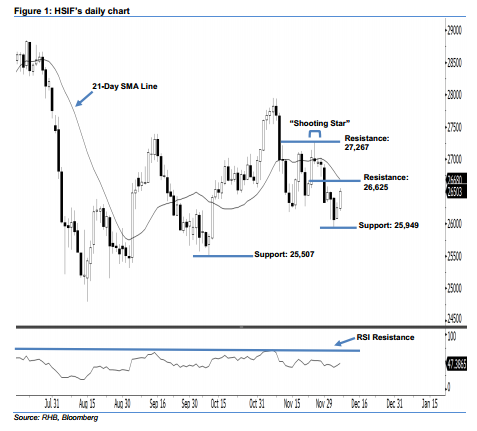

Stay short, with a new trailing-stop set above the 26,625-pt resistance. The HSIF formed another white candle last Friday. It rose to a high of 26,555 pts during the intraday session before ending at 26,503 pts for the day. However, we believe the selling momentum is not over yet, as the index has not recouped more than 50% of the losses from 29 Nov’s long black candle. Last Friday’s white candle indicates a technical rebound after the recent drop, in our view. We expect the market to decline further if the immediate 25,949-pt support is taken out decisively in the coming sessions.

According to the daily chart, we maintain the immediate resistance level at 26,625 pts – this is set near the midpoint of 29 Nov’s long black candle. If this level is taken out, look to 27,267 pts – the high of 26 Nov’s “Shooting Star” pattern – as the next resistance. To the downside, the immediate support level is seen at 25,949 pts, ie the low of 4 Dec. Meanwhile, the next support is anticipated at 25,507 pts, which was obtained from the previous low of 10 Oct.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 26,630-pt level on 22 Nov. For now, a new trailing-stop can be set above the 26,625-pt threshold in order to limit the risk per trade.

Source: RHB Securities Research - 9 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024