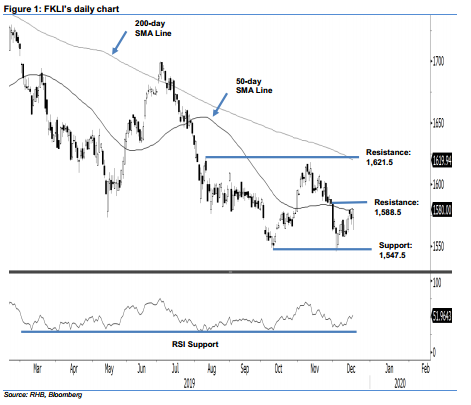

FKLI - Attempting to Cross the 50-Day SMA Line

rhboskres

Publish date: Wed, 18 Dec 2019, 05:47 PM

Maintain long positions as the bulls are attempting to cross the 50-day SMA line. The FKLI staged an intraday positive price reversal. At the closing, it settled 8 pts higher at 1,580 pts. Trading ranged between 1,563 pts and 1,580 pts. The positive session placed the index at the verge of breaking out from the 50-day SMA line. A firm break breakout from this SMA line would enhance the case for the ongoing countertrend rebound to extend further. Recap that the rebound resumed after it recently retested the 1,547.5-pt immediate support level. Maintain our positive trading bias.

On the observation that the countertrend rebound is still showing signs of extending, we recommend that traders remain in long positions. We initiated these at 1,568 pts, the closing level of 6 Dec. To manage risks, a stop-loss can be placed below 1,547.5 pts.

The immediate support is expected to emerge at 1,547.5 pts, the low of 10 Oct, followed by the 1,500-pt level. Towards the upside, the immediate resistance is set at 1,588.5 pts, the high of 29 Nov. This is followed by 1,621.5 pts, the high of 9 Aug.

Source: RHB Securities Research - 18 Dec 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024