Hang Seng Index Futures - A Persistent Upward Momentum

rhboskres

Publish date: Thu, 02 Jan 2020, 04:41 PM

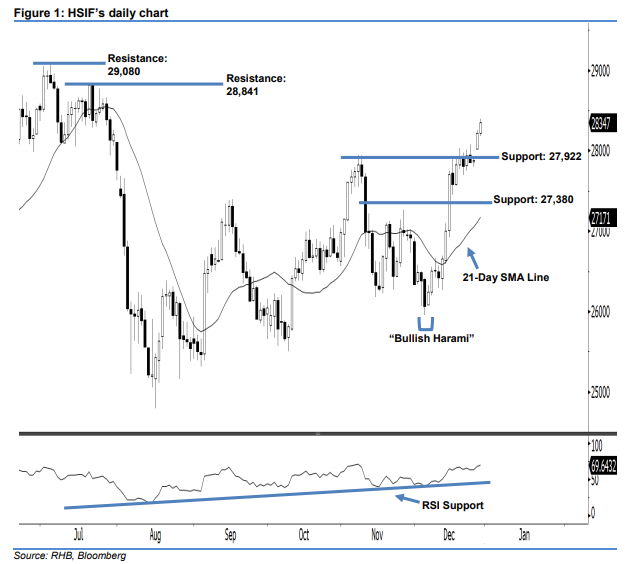

Stay long, with a new trailing-stop set below the 27,922-pt level. The HSIF’s upside move continued as expected, as another white candle was formed in its latest session. It rose to a high of 28,396 pts during the intraday session, before ending at 28,347 pts for the day. On a technical basis, the upside move is likely to continue, given that the index has posted a second consecutive white candle. The latest white candle can be viewed as a continuation of the bulls extending the buying momentum from 27 Dec 2019’s upside gap. As such, we think the bullish outlook stays intact. Presently, the immediate support level is seen at 27,922 pts – determined from the upside gap support of 27 Dec 2019. If a breakdown arises, look to 27,380 pts – set near the midpoint of 13 Dec 2019’s long white candle – as the next support. On the other hand, we are eyeing the immediate resistance level at 28,841 pts, which was the high of 19 Jul 2019. Meanwhile, the next resistance is situated at 29,080 pts, ie the previous high of 4 Jul 2019. To recap, we initially recommended traders to initiate long positions above the 26,500-pt level on 12 Dec 2019. We continue to advise them to stay long for now, while setting a new trailing-stop below the 27,922-pt threshold. This is to lock in a larger part of the profits.

Source: RHB Securities Research - 2 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024