FKLI: Another Possible Price Rejection

rhboskres

Publish date: Thu, 02 Jan 2020, 04:45 PM

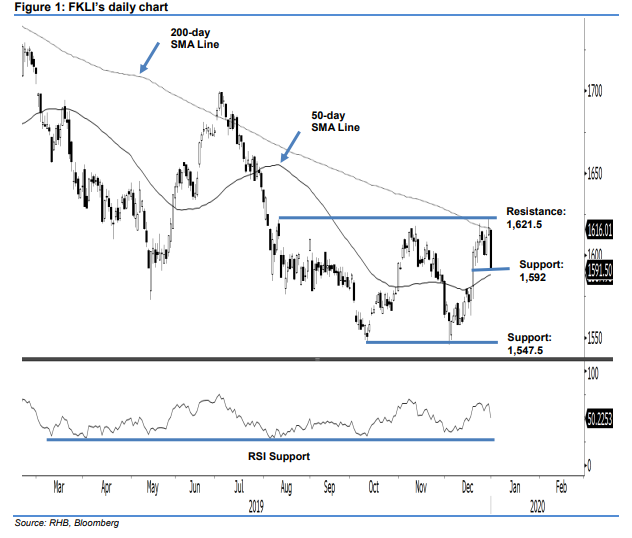

Maintain long positions while waiting for confirmation for a price rejection. The FKLI experienced a relatively sharp decline in the latest session, ending 27 pts weaker at 1,595 pts. The low and high were recorded at 1,592.5 pts and 1,620 pts. The negative session came after the index tested the immediate resistance of 1,621.5 pts in the prior session, heightening the risk for a possible price rejection. Recall that the index has attempted to cross above the said level twice, which also coincides with the 200-day SMA line, over the past 1.5 months. To confirm a price rejection, further negative actions are required in the coming sessions. Until this happens, we keep to our positive trading bias. Until there is a confirmation that the countertrend rebound has reached its end, we recommend that traders remain in long positions. We initiated these at 1,568 pts, the closing level of 6 Dec. To manage risks, a stop-loss can now be placed below 1,592 pts. The immediate support level is still pegged at 1,592 pts, set near the midpoint of 18 Dec’s “Long White Day” candle, followed by 1,547.5 pts, the low of 10 Oct. Meanwhile, the immediate resistance is expected at 1,621.5 pts, the high of 9 Aug. This followed by 1,650 pts.

Source: RHB Securities Research - 2 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024