WTI Crude Futures - Rebound Still Alive

rhboskres

Publish date: Fri, 03 Jan 2020, 05:08 PM

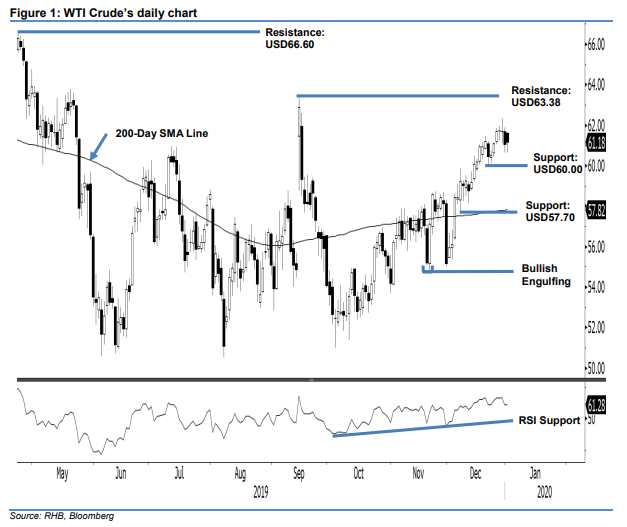

Maintain long positions. The WTI Crude ended the latest session USD0.12 higher at USD61.18. The session’s floor and ceiling were at USD60.64 and USD61.60. We believe the black gold’s price actions in the recent sessions are merely indicating a minor pause to its rebound which resumed from the low of the 20 Nov 2019’s “Bullish Engulfing” formation. This bias would stay, provided the immediate support of USD60 is not breached to the downside. Hence, we keep to our positive trading bias.

With no indication to signal the bulls have run out of steam, we maintain our advice for traders to stay in long positions. We initiated these at USD59.20, or the closing level of 6 Dec 2019. For risk-management purposes, a stop-loss can be placed at the breakeven level.

The immediate support is pegged at USD60.00, a round figure that is also near 20 Dec 2019’s low. This is followed by USD57.70, which was the low of 6 Dec 2019. Moving up, the immediate resistance is set at USD63.38, ie the high of 16 Sep 2019. This is followed by USD66.60, which was the high of 23 Apr 2019.

Source: RHB Securities Research - 3 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024