WTI Crude Futures - Testing Immediate Resistance

rhboskres

Publish date: Mon, 06 Jan 2020, 10:57 AM

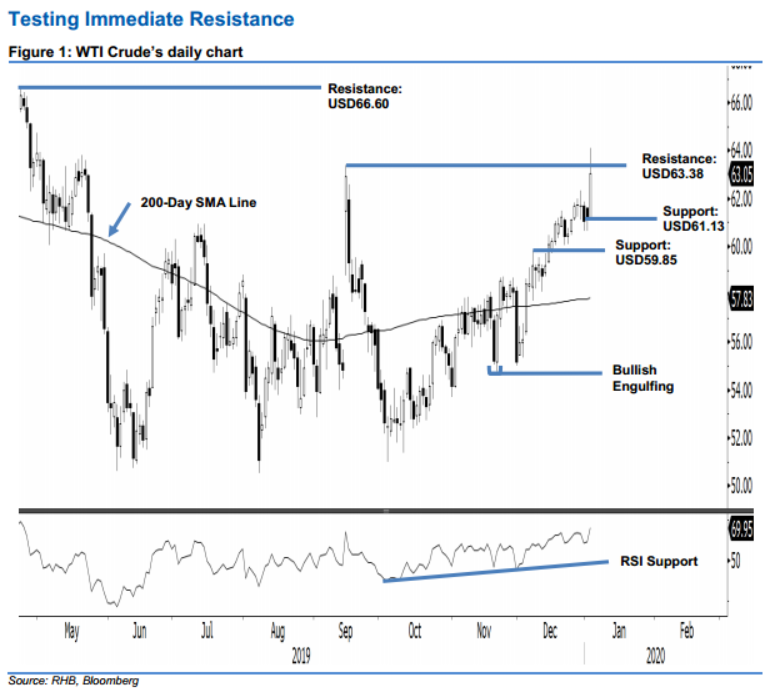

Maintain long positions while moving up the trailing-stop. The WTI Crude experienced a relatively strong positive session. At one point, it tested the immediate resistance of USD63.38 with an intraday high of USD64.09, before ending at USD63.05, indicating a gain of USD1.87. The black gold’s price actions around the said immediate resistance in the coming sessions are important in signalling its next directional bias. A price rejection from this level could increase the risk for the commodity’s rebound to hit an interim top. For now, we are keeping our positive bias.

In the absence of a price rejection from the said immediate resistance level, we maintain our advice for traders to stay in long positions. We initiated these at USD59.20, or the closing level of 6 Dec 2019. For risk-management purposes, a stop-loss can now be placed below USD61.13.

The immediate support is revised to USD61.13, the latest session’s low. This is followed by USD59.85, which was the high of 6 Dec 2019. Meanwhile, we are keeping the immediate resistance at USD63.38, ie the high of 16 Sep 2019. This is followed by USD66.60, which was the high of 23 Apr 2019.

Source: RHB Securities Research - 6 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024