E-mini Dow Futures - Upside Swing Stays Intact

rhboskres

Publish date: Mon, 06 Jan 2020, 11:01 AM

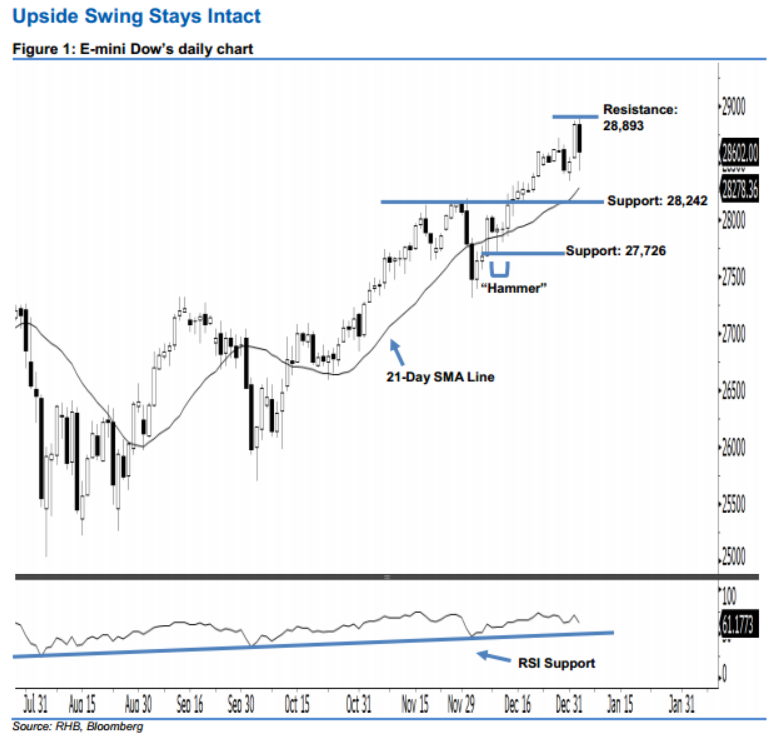

Stay long while setting a trailing-stop below the 28,242-pt support. After posting two white candles in a row, the E-mini Dow ended lower to form a black candle last Friday. It lost 239 pts to close at 28,602 pts, off its high of 28,893 pts and low of 28,431 pts. However, on a technical basis, last Friday’s black candle can be viewed as a pullback after the recent gains. We think the bullish sentiment has not diminished so far, given that the index is still trading above the rising 21-day SMA line. Overall, we remain bullish on the E-mini Dow’s outlook.

As seen in the chart, we anticipate the immediate support level at 28,242 pts, ie the low of 19 Dec 2019. The next support will likely be at 27,726 pts, which was the low of 10 Dec 2019’s “Hammer” pattern. Towards the upside, the immediate resistance level is now seen at the 28,893-pt record high. Meanwhile, the next resistance is situated at the 29,000-pt psychological spot.

Hence, we advise traders to stay long, following our recommendation to initiate long above the 28,159-pt level on 17 Dec 2019. A trailing-stop can be set below the 28,242-pt mark to limit the downside risk.

Source: RHB Securities Research - 6 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024