Hang Seng Index Futures: Another White Candle

rhboskres

Publish date: Mon, 20 Jan 2020, 04:08 PM

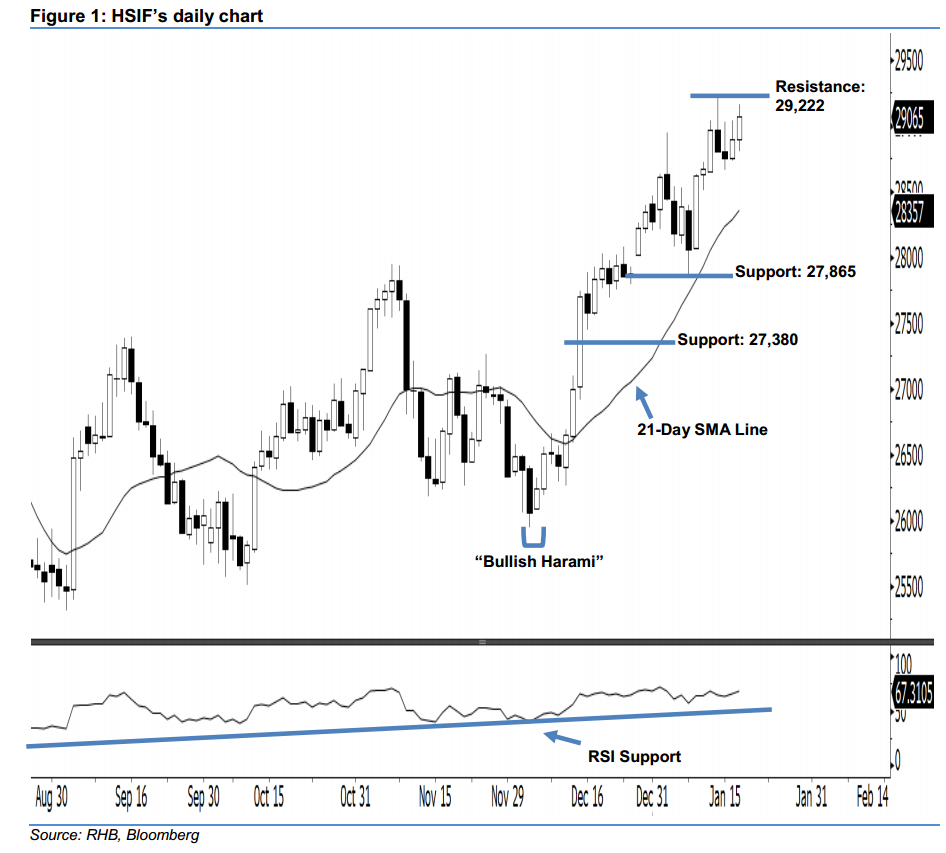

Maintain long positions. The HSIF’s upside move continued as expected, as a white candle was formed last Friday. It closed at 29,065 pts, off its high of 29,161 pts and low of 28,807 pts. On a technical basis, the upside move is likely to continue, given that the index has posted a second consecutive white candle. With the 21-day SMA line edging upwards, this also implies a bullish outlook sentiment. Overall, we expect the market to rise further if the previously mentioned immediate 29,222-pt resistance is taken out decisively in the coming sessions.

As seen in the chart, we are eyeing the immediate support level at 27,865 pts, which was defined from 8 Jan’s low. If this level is taken out, the next support will likely be at 27,380 pts – this is set near the midpoint of 13 Dec 2019’s long white candle. Towards the upside, the immediate resistance level is seen at 29,222 pts, ie the high of 14 Jan. Meanwhile, the next resistance is anticipated at the 30,000-pt psychological spot.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 26,500-pt level on 12 Dec 2019. A trailing-stop can be set below the 27,865-pt threshold to secure part of the gains.

Source: RHB Securities Research - 20 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024