Hang Seng Index Futures - the Selling Momentum Resumes

rhboskres

Publish date: Fri, 24 Jan 2020, 05:58 PM

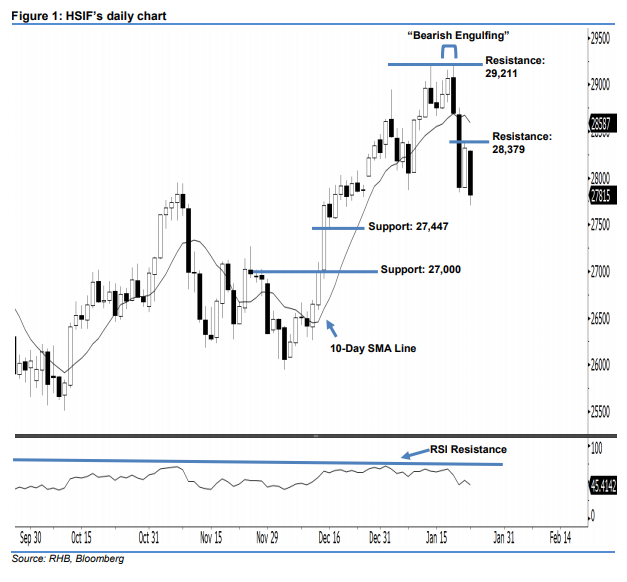

Stay short while setting a new trailing-stop above the 28,379-pt level. The HSIF formed a black candle yesterday. It closed at 27,815 pts, off the session’s high of 28,299 pts. Based on the current outlook, we think the sellers may have regained control of the market. This was as yesterday’s black candle erased the previous session’s gains. Given that the HSIF has taken out the previously indicated 27,843-pt support, this implies the downside swing that began from 20 Jan’s ‘Bearish Engulfing” pattern may carry on. Overall, we keep our bearish view on the index’s outlook.

As shown in the chart, the immediate resistance is now anticipated at 28,379 pts, which is set near the midpoint of 21 Jan’s long black candle. The next resistance will likely be at 29,211 pts – this was determined from the high of 20 Jan’s “Bearish Engulfing” pattern. Towards the downside, the near-term support level is now seen at 27,447 pts, ie the low of 16 Dec 2019. This is followed by the 27,000-pt psychological spot.

Therefore, we advise traders to stay short, since we originally recommended initiating short below the 28,300-pt level on 22 Jan. A new trailing-stop can be set above the 28,379-pt mark to minimise the risk per trade.

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024