FCPO - Retracement Has Probably Ended

rhboskres

Publish date: Wed, 05 Feb 2020, 06:20 PM

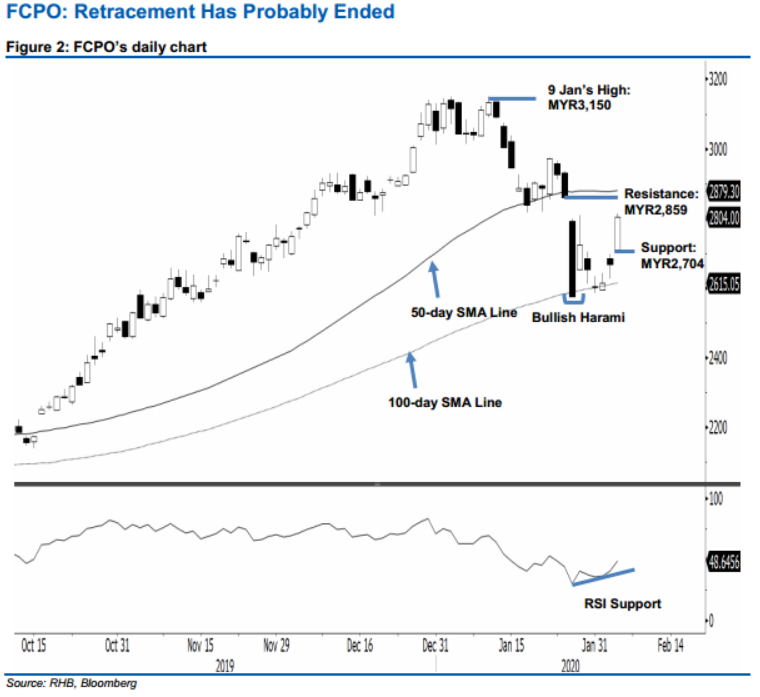

Eyeing for rebound; initiate long positions. The FCPO formed a white candle to settle the latest session MYR136 stronger at MYR2,804. The low and high were posted at MYR2,704 and MYR2,813. The strong session also crossed above the previous resistance levels of MYR2,700 and MYR2,753. This has, in our view, confirmed 29 Jan’s “Bullish Harami” formation which appeared near the 100-day SMA line. The said confirmation means the commodity has probably completed its multi-week retracement phase and is now likely to stage a stronger rebound, if not a resumption of its multi-month uptrend. Switch our trading bias to positive.

Our previous short positions initiated at MYR2,652, the closing level of 30 Jan was closed out at MYR2,753 in the latest session. As a stronger rebound is taking place, we initiate long positions at the latest close. To manage risks, a stoploss can be placed below MYR2,704.

The immediate support is revised to MYR2,750, derived from the latest candle. This is followed by MYR2,704, the latest low. Moving up, immediate resistance is now eyed at MYR2,859, the low of 24 Jan. This is followed by the MYR2,900 round figure.

Source: RHB Securities Research - 5 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024