Hang Seng Index Futures - Sentiment Stays Negative

rhboskres

Publish date: Wed, 26 Feb 2020, 05:18 PM

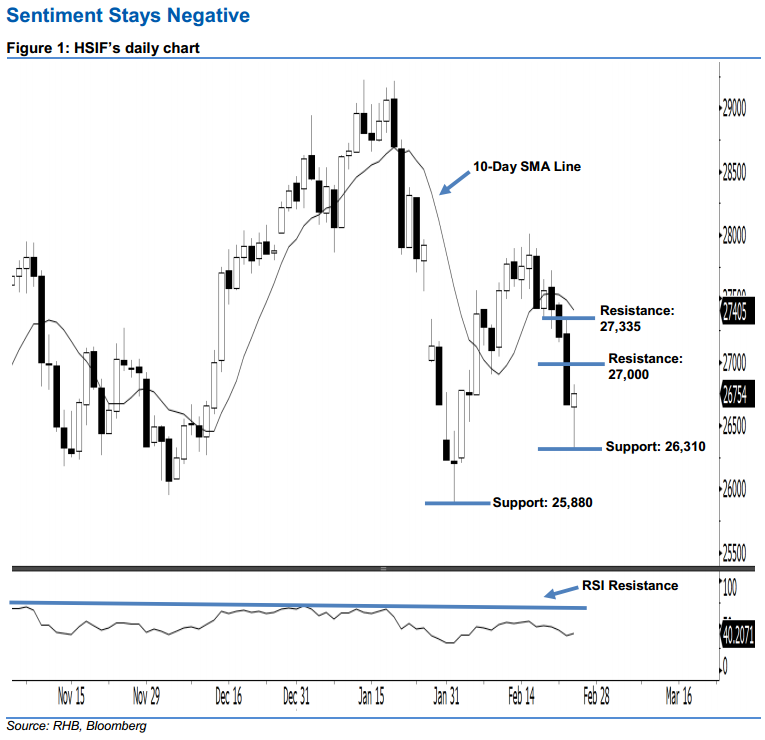

Stay short while setting a trailing-stop above the 27,000-pt level. After posting three black candles in a row, the HSIF ended higher to form a positive candle yesterday. It settled at 26,754 pts, off its high of 26,825 pts and low of 26,310 pts. However, on a technical basis, yesterday’s positive candle can be viewed as a technical rebound after the recent losses. We think the bears may continue to control the market, given that the index did not recoup more than 50% losses from 24 Feb’s long black candle. Overall, we keep our bearish view on the HSIF’s outlook.

Based on the daily chart, the immediate resistance level is maintained at the 27,000-pt psychological spot, also set near the midpoint of 24 Feb’s long black candle. The next resistance is seen at 27,335 pts, ie the high of 24 Feb. To the downside, we are eyeing the near-term support level at 26,310 pts, defined from 25 Feb’s low. This is followed by 25,880 pts, which was the previous low of 3 Feb.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 27,000-pt level on 25 Feb. For now, a trailing-stop can be set above the 27,000-pt threshold as well in order to minimise the risk per trade.

Source: RHB Securities Research - 26 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024