WTI Crude Futures - Tagging the Counter-Trend Rebound

rhboskres

Publish date: Wed, 11 Mar 2020, 04:35 PM

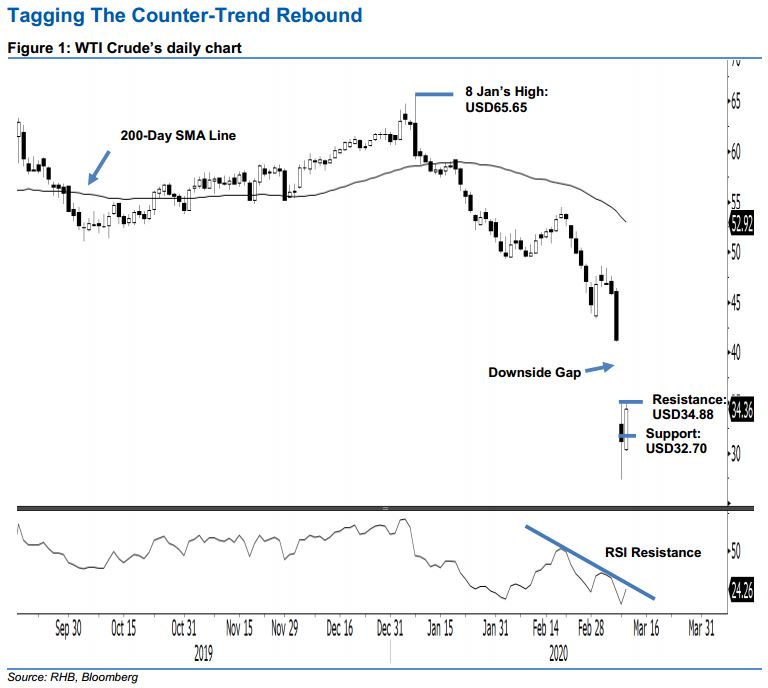

Counter-trend rebound signal triggered – initiate long positions. The WTI Crude continued to trade in a wide range for the third consecutive session. It formed a white candle to hand in a USD3.23 gain, settling at USD34.36 after ranging between USD30.20 and USD35.02. The closing level also crossed above the previous USD33.50 immediate resistance – signalling the good possibility of a counter-trend rebound developing. This is meant to correct the commodity’s recent sharp decline, which sent the RSI reading into extremely oversold territory. Hence, we switch our trading bias to positive from negative previously.

Our previous short positions – initiated at USD49.90, or the closing level of 25 Feb – was closed out at USD33.50 during the latest session. On the bias that a rebound is taking place, we initiate long positions at the latest closing level. To manage the risk, a stop-loss can be placed below the USD31.50 mark.

We revised the immediate support level to USD32.70, followed by USD31.50 – both were derived from the latest session’s price range. Towards the upside, the immediate resistance is set at USD34.88, or the high of 9 Mar. This is followed by the USD36.00 threshold.

Source: RHB Securities Research - 11 Mar 2020