COMEX Gold - Risk for Extended Correction Increased

rhboskres

Publish date: Mon, 04 May 2020, 09:39 AM

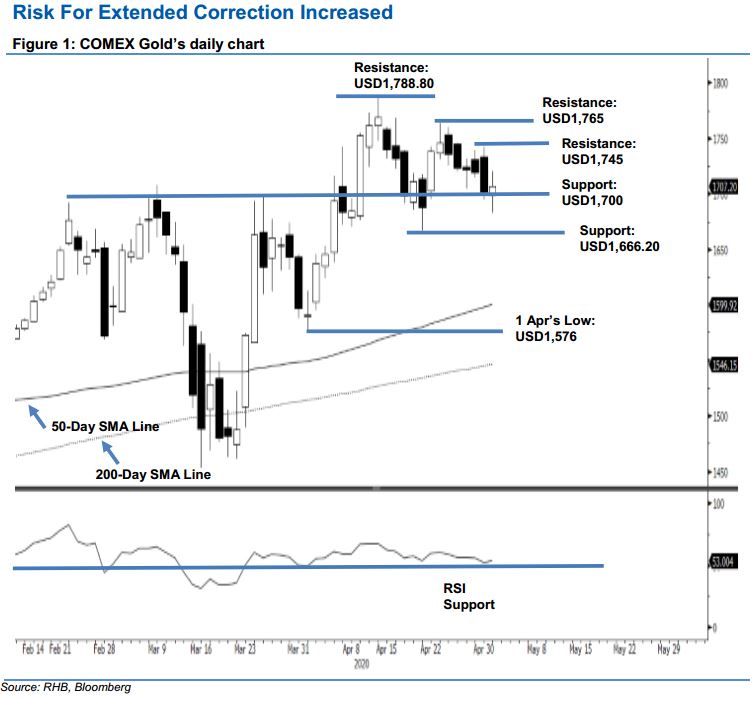

Correction phase seems incomplete; maintain short positions. The COMEX Gold ended the latest session higher at USD1,704.20 – this was after it reached a low of USD1,683.30. Although it managed to sustain its closing level above the important resistance-turned-support level of USD1,700, based on the commodity’s price actions over the past two weeks, we believe its correction phase - which set in after it reached a high of USD1,788.80 on 14 Apr - is still incomplete and likely to extend. This negative bias could be further reinforced should the USD1,700 support level be breached decisively in the coming sessions. Maintain negative trading bias.

We advise traders to stay in short positions. These were initiated at USD1,701 – the closing level of 30 Apr. For risk management purposes, a stop-loss can be placed above USD1,745.

The immediate support is pegged at the USD1,700 round figure, followed by USD1,666.20 – the low of 21 Apr. Meanwhile, the immediate resistance is eyed at USD1,745 – near the high of 30 Apr, followed by USD1,765 – near the high of 23 Apr.

Source: RHB Securities Research - 4 May 2020