WTI Crude - Bullish Momentum Emerges

rhboskres

Publish date: Mon, 29 Mar 2021, 09:35 AM

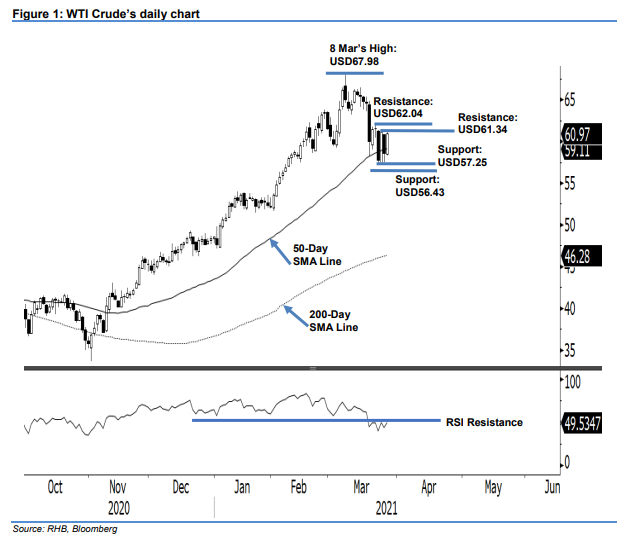

Maintain short positions. The WTI Crude rebounded from the 50-day SMA line, rising USD2.41 to settle at USD60.97. After starting the session at USD58.48, it dipped to a low of USD58.32 and moved sideways. During the US trading hours, it climbed to the session’s high of USD61.36, and was last traded at USD60.97. The commodity is struggling to stay above the USD60.00 psychological level. As the RSI is moving below the 50% threshold, we should see more consolidations at the USD60.00 level – the commodity is likely to move sideways in this region. However, a breach of the USD61.34 level may see momentum shift to the upside, and ignite bullish momentum. Until then, the commodity is capped by a “lower high” formation, and could revert to a downward movement after consolidation. Premised on this, we maintain our negative trading bias.

We recommend traders to stick to short positions. We initiated these at USD60.06, or the closing level of 18 Mar. To manage risks, the stop-loss is placed at USD61.34.

The nearest support level is kept at 23 Feb’s USD57.25 low, followed by 5 Feb’s USD56.43 low. On the upside, the immediate resistance is pegged at 24 Mar’s USD61.34 high, followed by USD62.04.

Source: RHB Securities Research - 29 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024