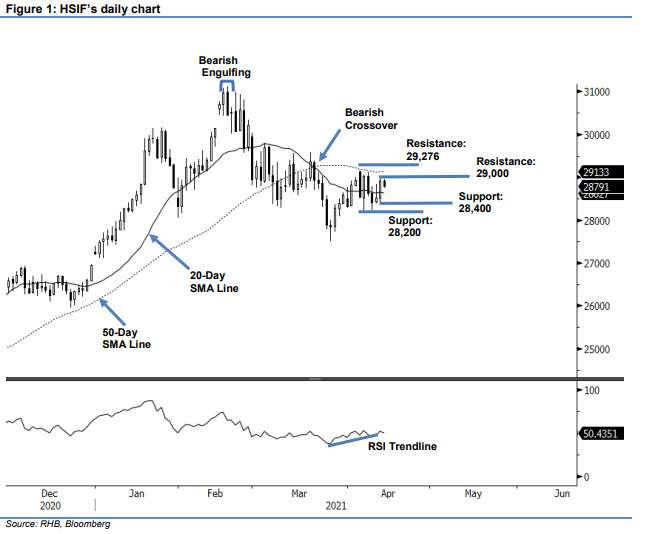

Hang Seng Index Futures - Crossing Above the 20-Day SMA Line

rhboskres

Publish date: Thu, 15 Apr 2021, 04:24 PM

Maintain short positions. The HSIF managed to reclaim the 20-day SMA line yesterday, jumping 396 pts to settle the day session at 28,915 pts. The index started the day session at 28,648 pts and dipped towards the day low at 28,618 pts before surging to the 28,966-pt day high. During the evening session, the bears were taking profits, which saw the HSIF correcting to close at 28,762 pts. As mentioned in our previous note, the index needs to trade above the 20-day SMA line to maintain the recent counter-trend rebound. Falling below the moving average will see the correction phase – which started from the Bearish Crossover – being extended lower. Breaching the 28,200-pt support level may open the door for a deep correction. Despite a brief rebound yesterday, the 20-day SMA line still pointed downwards. Hence, we maintain our negative trading bias until the stop loss is breached.

We recommend traders maintain short positions initiated at 28,411 pts, or the closing level of 12 Apr. For riskmanagement purposes, the stop-loss level is set at 29,050 pts.

The immediate support is revised to the 28,400-pt round figure and followed by 28,200 pts. The immediate resistance is revised to the 29,000-pt psychological level and followed by 11 Mar’s close of 29,276 pts.

Source: RHB Securities Research - 15 Apr 2021