FCPO - Attempting To Cross MYR3,800

rhboskres

Publish date: Thu, 15 Apr 2021, 04:30 PM

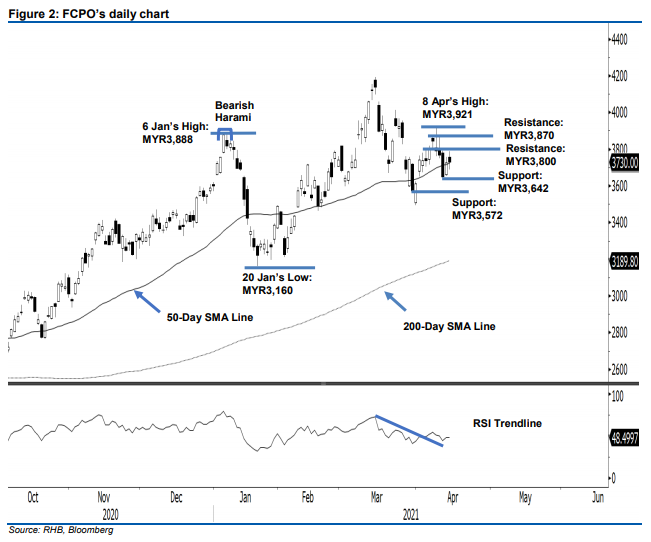

Maintain short positions. Altough there was selling pressure during the final trading hour, the FCPO added MYR4.00 and closed at MYR3,730 yesterday. It gapped upwards at the open, at MYR3,758, then fell to the day’s low of MYR3,686. Then, the commodity rebounded towards the day’s high of MYR3,787, before ended the choppy session at MYR3,730. From the latest price action, following the Bullish Harami pattern that formed on Tuesday, the bulls managed to consolidate and edge higher yesterday. The upward movement that was sparked by brief buying interest remain capped by the MYR3,800 resistance (which has been in place since early this month). Buyers may stage a last attempt on 15 Apr to cross the MYR3,800 point, before futures contracts roll over on 16 Apr. We maintain a negative trading bias, until the stop-loss is breached.

We recommend that traders stay in short positions, initiated at the closing level of 12 April, at MYR3,650. To manage risks, a stop-loss is placed above MYR3,800.

We also maintain the immediate support at 12 Apr’s low of MYR3,642, then MYR3,572, which is 30 Mar‘s close. Towards the upside, the immediate resistance stays at the psychological level of MYR3,800, followed by April 7’s high of MYR3,870.

Source: RHB Securities Research - 15 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024