FKLI - Bouncing Off The 50-Day SMA Line

rhboskres

Publish date: Thu, 15 Apr 2021, 04:30 PM

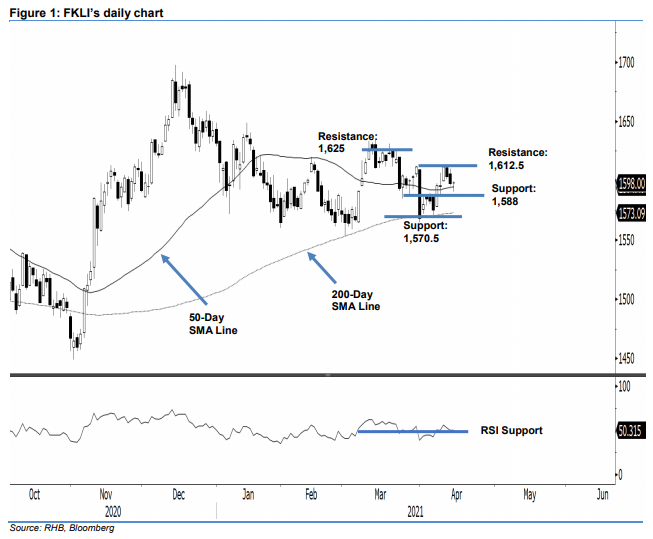

Maintain long positions. Bullish interest emerged near the 50-day SMA line yesterday, and the FKLI rose 0.50 pts to close at 1,598 pts. Following a bearish session on Tuesday, it opened at 1,598 pts, and dropped to touch the day’s low of 1,590.5 pts before reversing towards the day’s high of 1,599.5 pts. The index also formed a Dragonfly Doji pattern near the 50-day SMA line. The long lower shadow formation indicates that the bulls were accumulating near the day’s low, while selling pressure subsided. If the index stages a rebound in the coming sessions, the RSI indicator may curve higher – and buyers should gain strength to retest the immediate resistance of 1,612.50 pts. As long as it remains above 1,588 pts or stop-loss level, we make no change to our positive trading bias.

We suggest that traders stick to long positions, which were initiated at 1,596 pts, or the closing level of 7 Apr. To manage risks, the stop-loss is set below 1,588 pts.

The immediate support level remains at 1,588 pts, followed by 6 Apr’s low of 1,570.50 pts. Towards the upside, the immediate resistance is unchanged at 30 Mar’s high of 1,612.5 pt, followed by 1,625 pts.

Source: RHB Securities Research - 15 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024