WTI Crude - Edging Higher After the Breakout

rhboskres

Publish date: Fri, 16 Apr 2021, 04:52 PM

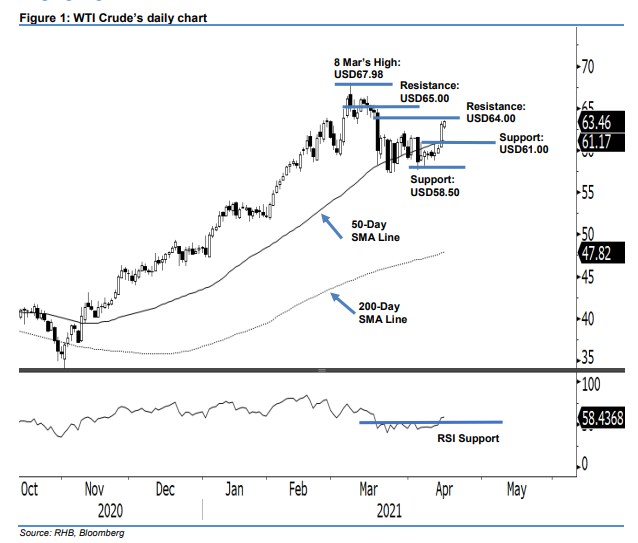

Maintain long positions. Yesterday, the WTI Crude settled near the previous day’s high, at USD63.46, inching USD0.31 higher and signalling a possible resumption of the uptrend. It opened Thursday’s session with slightly weak momentum at USD62.83, before touching the day’s bottom of USD62.53. However, buying interest emerged and pushed it towards the high of USD63.57, before closing at USD63.46. From the latest price action, the black gold is defying the profit-taking, while firming up its recent breakout above the consolidation zone. With this, the bulls may continue to move towards the next resistance levels set at USD64.00, followed by USD65.00. However, if a sudden change of direction happens, it may retest the immediate support level of USD61.00. As the WTI Crude remains above the consolidation zone, we maintain our positive trading bias.

We suggest traders stay in the long positions initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop-loss is set at USD58.50.

The nearest support level is kept at USD61.00, followed by USD58.50. Towards the upside, the immediate resistance is fixed at the USD64.00 round figure, followed by USD65.00.

Source: RHB Securities Research - 16 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024