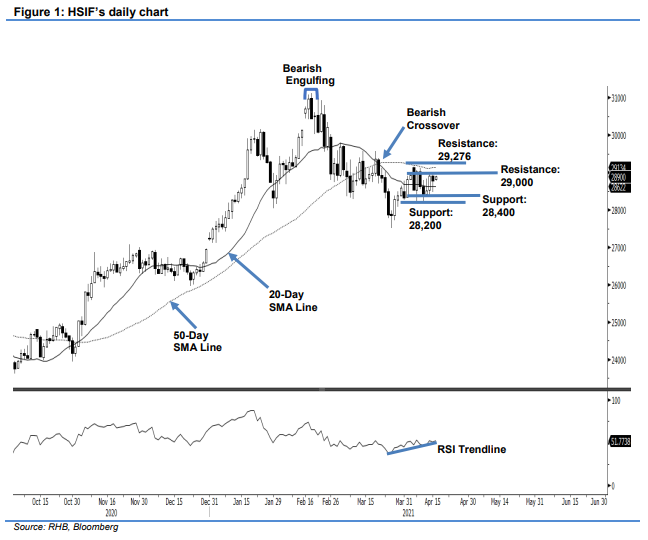

Hang Seng Index Futures - Building a Base Near the 20-Day SMA Line

rhboskres

Publish date: Fri, 16 Apr 2021, 04:53 PM

Maintain short positions. The HSIF is seen building a consolidation point near the 20-day SMA line, dipping 135 pts to settle the day’s session at 28,780 pts. It started the session at 28,845 pts before touching a high of 28,885 pts. Selling pressure during the early part of the session dragged the index to a low of 28,473 pts. During midday, it recouped its losses to close at 28,780 pts. The mild bullish momentum continued into the evening session, and the index was last traded at 28,900 pts after testing the session’s high of 28,912 pts. While still capped by the overhead 50-day SMA line, it managed to stay above the 20-day SMA line. We observe that the 20-day SMA line is pointing south. The index has to stay above the 20-day SMA line at least until 21 Apr – or the next three trading sessions – so the SMA line can curve higher. Until then, we maintain our negative trading bias.

We recommend traders stick to the short positions initiated at 28,411 pts, or the closing level of 12 Apr. For risk management purposes, the stop-loss is placed at 29,050 pts.

The immediate support remains at the 28,400-pt round figure, followed by 28,200 pts. The immediate resistance is pegged at the 29,000-pt psychological level, followed by 11 Mar’s close of 29,276 pts.

Source: RHB Securities Research - 16 Apr 2021