FCPO - Bullish Momentum Emerges

rhboskres

Publish date: Fri, 16 Apr 2021, 05:00 PM

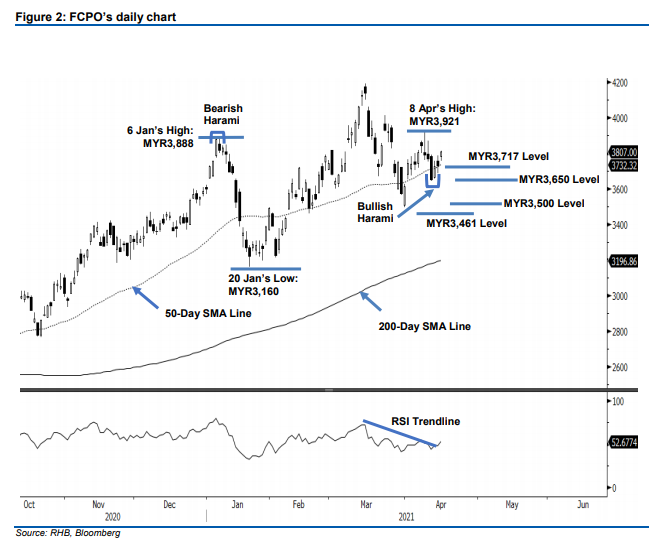

Stop-loss triggered; initiates long positions. Buying momentum emerged at the final trading hour yesterday, and pushed the FCPO past the resistance of MYR3,800 to see Jun 2021 futures contract closing at MYR3,807. It opened at MYR3,780 and stayed sideways for most of the session. In the late afternoon, it fell towards the day’s low of MYR3,757, before reversing direction and climbing towards the day’s high of MYR3,813. The strong momentum echoes the Bullish Harami pattern formed on 13 Apr, which is near to the 50-day SMA line. As such, the commodity may see the bullish momentum follow through in the sessions ahead. The commodity will see futures contract roll over to Jul 2021 on 16 Apr. We do expect to see a gap-down on 16 Apr at the opening, but believe the bullish momentum may prevail. Since the trend is tilted towards the bulls, we switch our trading bias to a positive one.

We closed out short positions – initiated at MYR3,650 or the close of 12 Apr – after stop-loss point of MYR3,800 was triggered. Conversely, we initiated long positions on Jul 2021 contract’s closing level, ie MYR3,590. To manage risks, a stop-loss is placed below MYR3,461.

The Jul 2021 futures contract may see prices facing downside support at MYR3,500, followed by 18 Feb’s low of MYR3,461. Towards the upside, it may test the MYR3,650 level, followed by the MYR3,717 point.

Source: RHB Securities Research - 16 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024