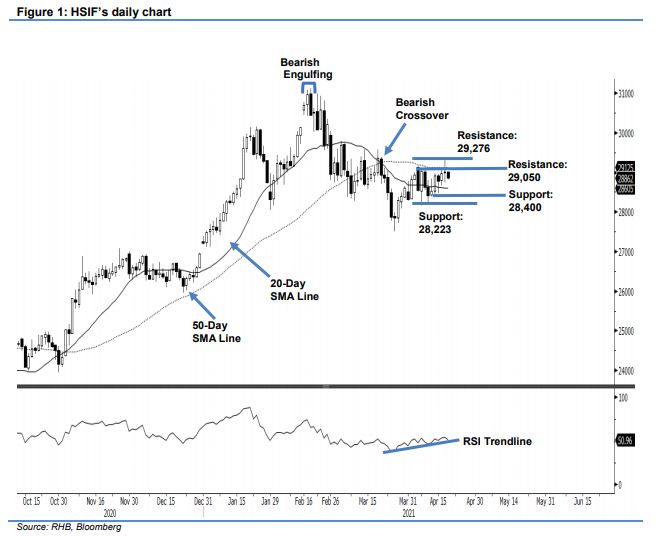

Hang Seng Index Futures - Capped by the 50-Day SMA Line

rhboskres

Publish date: Tue, 20 Apr 2021, 08:36 AM

Maintain short positions. Although crossing above the 50-day SMA line during the intra-day period, the HSIF fell below the moving average towards the late session. The index started the day session yesterday at 28,948 pts. After reaching the 28,749-pt day low, it jumped to the day high of 29,318 pts. Strong selling pressure above the 50-day SMA line brought it down to close at 29,020 pts – recording a 40-pt gain vs the previous session. In the evening, the bears continued trimming positions and the HSIF closed lower at 28,862 pts. As long as the index stay above the 20- day SMA line for the next two sessions, we may see the moving average curving up. This may push it higher to retest the 50-day SMA line in the coming sessions. However, falling below the 20-day SMA line may see the resumption of downward movements. Since the stop loss stays intact, we maintain our negative trading bias.

We recommend traders maintain the short positions initiated at 28,411 pts, or the closing level of 12 Apr. For riskmanagement purposes, the stop loss is placed at 29,050 pts.

The immediate support exist at the 28,400-pt round figure – this is followed by 12 Apr’s low of 28,223 pts. The immediate resistance is seen at the 29,050-pt whole number and followed by 11 Mar’s close of 29,276 pts.

Source: RHB Securities Research - 20 Apr 2021