E-Mini Dow - Consolidating Near 34,000 Pts

rhboskres

Publish date: Tue, 20 Apr 2021, 08:38 AM

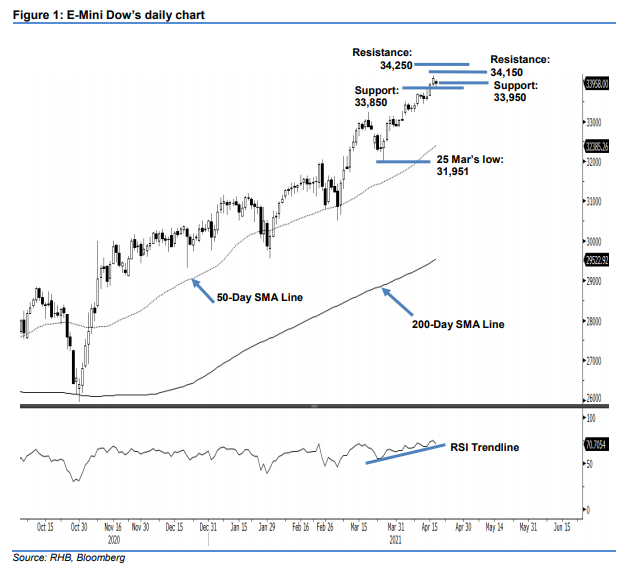

Maintain long positions. The E-Mini Dow showed early signs of weakness during the first trading session of the week, falling 123 pts to settle at 33,958 pts. On Monday, it started the session at 34,015 pts – above the 34,000-pt psychological level. After testing the session high at 34,048 pts, it retraced towards the 33,860-pt session low during the US trading hours. It closed the session at 33,958 pts – forming a long lower shadow candlestick pattern. Although the index managed to close the session near to its high, a long lower shadow suggests selling pressure emerging near 34,000 pts. Coupled with the RSI turning downwards, we may see such pressure persisting near 34,000 pts, and negative momentum may follow through in the coming sessions. Hence, the E-Mini Dow may correct and test the support levels marked at 33,950 pts and 33,850 pts. As long as the support holds, the index may resume its upward movement post correction. Premised on this, we maintain our positive trading bias.

We recommend traders stick to the long positions initiated at 31,509 pts, or the closing level of 1 Mar. For riskmanagement purposes, the trailing stop is set at 33,400 pts.

The immediate support is placed at 33,950 pts, followed by the 33,850-pt round figure. On the upside, the immediate resistance is projected at the 34,150-pt round figure and followed by 34,250 pts.

Source: RHB Securities Research - 20 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024