COMEX Gold - Upward Movement Paused

rhboskres

Publish date: Tue, 20 Apr 2021, 08:41 AM

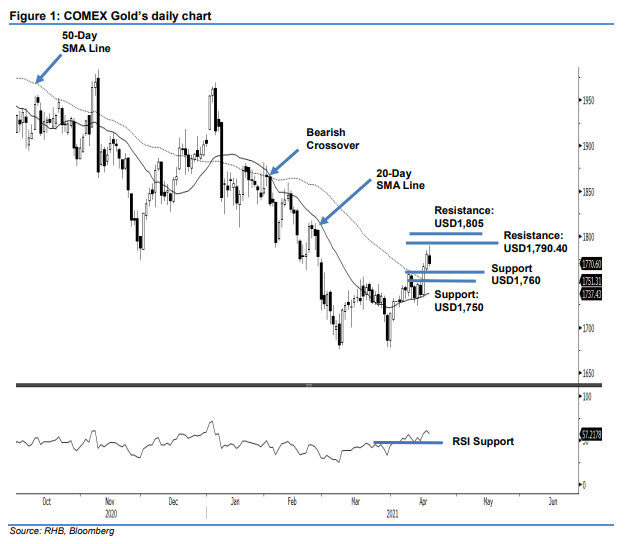

Maintain long positions. The COMEX Gold saw the upward movement halted due to the bears’ profit-taking – it declined USD9.60 to settle at USD1,770.60. It started the Monday session on a stronger note at USD1,778.80. It stayed sideways for most of the session, before climbing to the day high at USD1,790.40 during the London trading hours. However, selling pressure emerged during the US trading hour, where the COMEX Gold fell towards the USD1,766.60 day low – forming a Bearish Harami pattern near the USD1,790.40 resistance. If profittaking activities are extended, the commodity may correct lower to test the USD1,760 support. A breakdown of the support may see further corrections towards the 50- or 20-day SMA lines. As long as the stop-loss level remains intact, we stick to our positive trading bias.

We recommend traders keep to the long positions initiated at USD1,715.60 on 31 Mar. For risk-management purposes, the trailing stop is raised to USD1,760.

The immediate support is placed at the USD1,760 round figure, followed by USD1,750. Towards the upside, the nearest resistance is pegged at 19 Apr’s high of the USD1,790.40 whole number and followed by USD1,805.

Source: RHB Securities Research - 20 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024