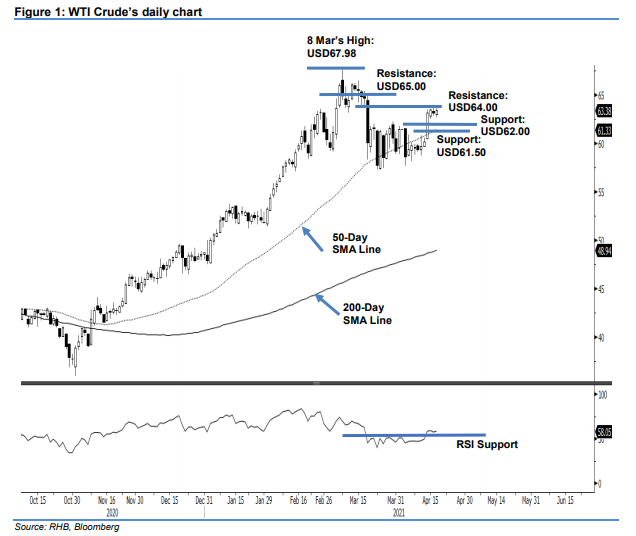

WTI Crude - Testing Resistance Near USD64.00

rhboskres

Publish date: Tue, 20 Apr 2021, 08:42 AM

Maintain long positions. The WTI Crude saw a positive session yesterday, rebounding USD0.25 to settle at USD63.38. Although the commodity started Monday’s session weaker at USD62.98, after reaching the session low at USD62.63, it recouped the earlier losses and rose to the US63.63 session high. With the latest price action, the WTI Crude is consolidating near the resistance level and may retest the USD64.00 upside resistance in the coming sessions. If it takes out the resistance, the bulls will gain strength and lift the commodity to test the higher hurdle at USD65.00. Otherwise, the black gold may see further sideways consolidation or pull back towards the immediate support marked at USD62.00. As long as the WTI Crude stays above the 50-day SMA line or USD61.56 level, we retain our positive trading bias. Note: The daily chart will be switched to Jun 2021 futures contracts on 20 Apr.

We suggest traders keep the long positions initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop loss is revised higher to the breakeven point, ie USD61.56.

The nearest support level is set at the USD62.00 round figure and followed by USD61.50. Towards the upside, the immediate resistance kept at the USD64.00 round figure, followed by USD65.00.

Source: RHB Securities Research - 20 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024