Hang Seng Index Futures - Hanging on to the 20-Day SMA Line

rhboskres

Publish date: Thu, 22 Apr 2021, 04:51 PM

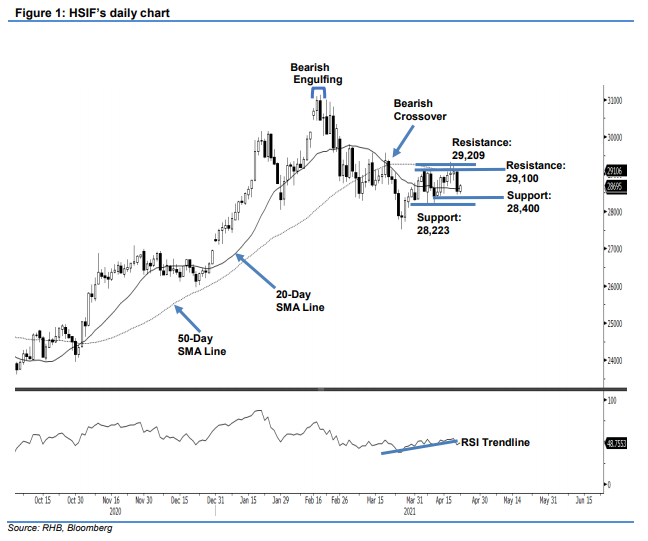

Maintain long positions. The HSIF experienced one of its worst sessions since 24 Mar, shedding 539 pts to settle the day session at 28,532 pts. It started Wednesday’s session with a gap down to 28,723 pts. After reaching a high of 28,750 pts, it fell to the day’s low of 28,448 pts and stayed sideways before ending at 28,532 pts. In the evening session, bargain hunting by the bulls lifted it to close at 28,695 pts – staying above the 20-day SMA line. As mentioned in our previous note, the HSIF is on the verge of seeing its 20-day SMA line curving higher – if the index continues to trade above the moving average, we may see it curve up by 23 Apr. Meanwhile, a fall below the 20-day SMA line or the 28,223 support level will see the index reverting to downtrend mode. Until then, we will stick to our positive trading bias.

We recommend traders shift to the long positions initiated at 29,071 or the closing level of 20 Apr. For risk management purposes, the stop-loss is set at 28,223 pts.

The immediate support is marked at the 28,400-pt round figure, followed by 12 Apr’s low of 28,223 pts. The immediate resistance is revised to the 29,100-pt round figure, followed by 20 Apr’s high of 29,209 pts.

Source: RHB Securities Research - 22 Apr 2021