FCPO - Bulls Tire Near MYR4,000 Level

rhboskres

Publish date: Fri, 23 Apr 2021, 05:10 PM

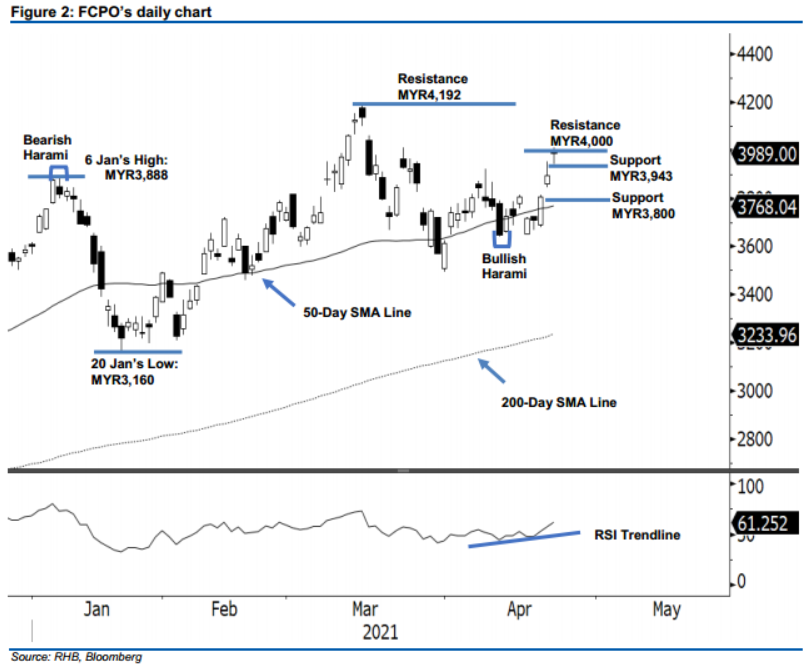

Maintain long positions, with a stricter trailing-stop revised upwards. The rally on the FCPO may have paused, as the commodity closed MYR95.00 higher, with a doji at MYR3,989, ie near the psychological resistance level yesterday. This points to an “evening star doji” pattern, signalling a possible reversal from the top. It opened higher with a gap at MYR3,990 then oscillated between a high of MYR4,010 and a low of MYR3,943, before closing. The pause in the bullish momentum after the gap-up yesterday indicates that the bulls may be exhausted at the peak. We mentioned the probability of profit-taking in an earlier note. This possibility is becoming more apparent, based on yesterday’s movement. Although the medium-term uptrend remains intact above the 50-day SMA line, the short-term reversal is likely to be confirmed if the negative price action follows through ahead. Therefore, we stick to a positive trading bias, with a stricter trailing-stop (revised higher).

Traders should maintain long positions, which were initiated at MYR3,590 or the close of the Jul 2021 contract on 15 Apr. To manage risks, the trailing stop is revised higher to MYR3,943 – which is 22 April’s low.

The immediate support is marked at MYR3,943, followed by MYR3,800. Towards the upside, the immediate resistance is pegged at the MYR4,000 psychological level, followed by MYR4,192 – 15 Mar’s high.

Source: RHB Securities Research - 23 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024