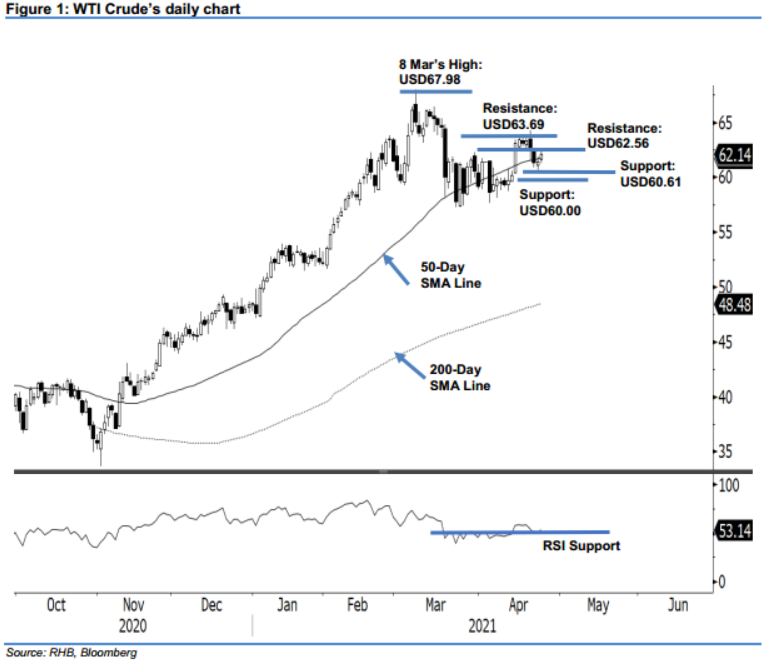

WTI Crude - Climbing Above the 50-Day SMA Line

rhboskres

Publish date: Mon, 26 Apr 2021, 09:25 AM

Maintain short positions. The WTI Crude managed to climb above the 50-day SMA line, adding USD0.71 to settle at USD62.14. Last Friday, the commodity started the session at USD61.65. After trading between the day high and low of USD62.43 and USD61.25, it last traded at USD62.14 – extending the bullish momentum since Thursday’s session. If the RSI indicator continues to hover above the 50% threshold, the positive momentum will continue to lift the WTI Crude higher towards the USD62.56 immediate resistance. Breaching this resistance may see the formation of a “higher high”. Conversely, falling below the 50-day SMA line may see the commodity reverting to a downwards movement. Since the stop loss remains intact, we stick to our negative trading bias.

We recommend traders maintain the short positions initiated at USD61.35, or the closing level of 21 Apr. To manage risks, the initial stop-loss threshold is set at USD63.50.

The nearest support level is revised to USD60.61 – 22 Apr’s low – and followed by the USD60.00 psychological level. Towards the upside, the immediate resistance remains at USD62.56, followed by 19 Apr’s high of USD63.69.

Source: RHB Securities Research - 26 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024