WTI Crude - Rebounding From the 50-Day SMA Line

rhboskres

Publish date: Wed, 28 Apr 2021, 04:36 PM

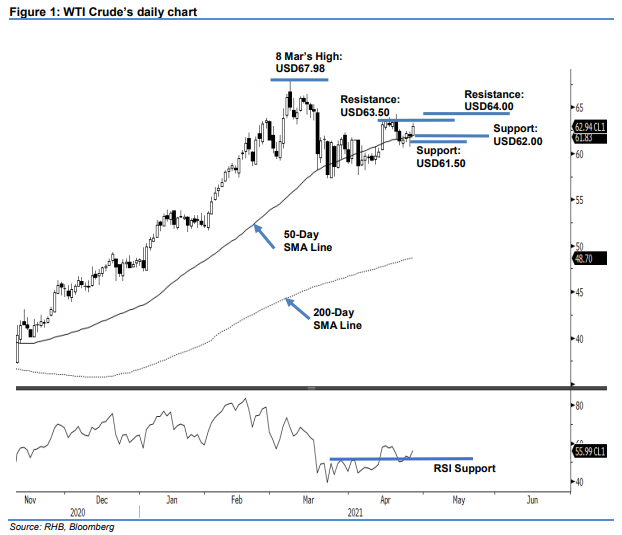

Maintain short positions. The WTI Crude managed to bounce off the 50-day SMA line, adding USD1.03 to settle at USD62.94. It started Tuesday’s session at USD61.97. After the commodity found its day low at USD61.91, it gradually move higher throughout the session and reached the USD63.30 day high. The WTI Crude last traded at USD62.94 – breaching the previous USD62.56 resistance. Since the commodity has breached the resistance, it has formed a “higher high” pattern, indicating that the bullish momentum is gaining pace. If the momentum extends, the WTI Crude may test the next resistance at USD63.50. Moving higher from this level may trigger short-covering activities by the bears that will propel prices higher. Conversely, failing to break this resistance may see the commodity moving back to a consolidation mode. We stick to our negative trading bias until the stop loss is breached.

We recommend traders maintain short positions initiated at USD61.35, or the closing level of 21 Apr. To manage risks, the stop-loss threshold is set at USD63.50.

The nearest support level is revised to USD62.00, followed by the USD61.50 whole number. Towards the upside, the immediate resistance is revised to USD63.50 and followed by the USD64.00 psychological level.

Source: RHB Securities Research - 28 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024