WTI Crude - Rising on a Higher High Pattern

rhboskres

Publish date: Fri, 30 Apr 2021, 05:37 PM

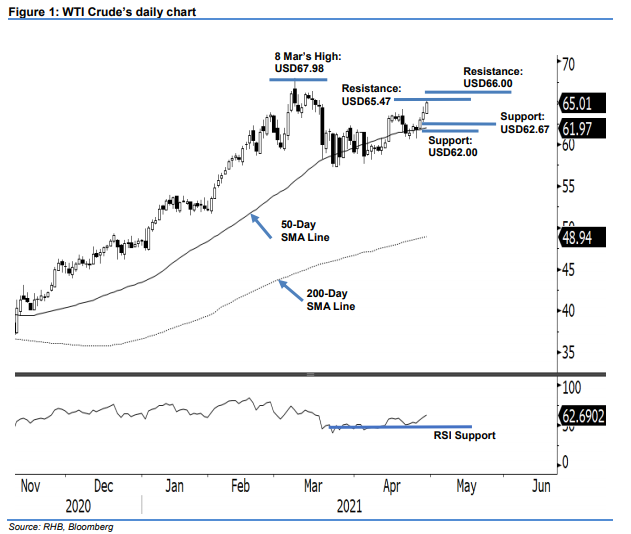

Stop-loss triggered; Initiate long positions. The WTI Crude crossed above the USD64.00 psychological level to settle at USD65.01 yesterday. Following a surge on Wednesday – breaking past the previous USD63.50 resistance level – the commodity concluded Thursday’s session with another bullish candlestick, displaying a ‘Three White Soldiers’ pattern on the chart. The pattern suggests that bullish momentum will follow through in coming sessions to test the USD66.00 upside resistance level, or at least the recent high of USD65.47. We do not rule out the possibility of profit-taking, but expect strong support near the 20-day SMA line or USD62.00. As the commodity is marching on a “higher high” pattern, coupled with the breach of the stop-loss, we shift over to a positive trading bias.

We closed out the short positions initiated at USD61.35, or the closing level of 21 Apr, after the stop-loss was triggered at USD63.50 on 28 Apr. We initiate long positions at 28 Apr’s close, ie USD63.86. To manage risks, we set a stop-loss at USD62.00.

The nearest support is revised to 28 Apr’s low of USD62.67, followed by the USD62.00 round figure. The immediate resistance is revised to 29 Apr’s high of USD65.47, followed by USD66.00.

Source: RHB Securities Research - 30 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024