E-Mini Dow - Bullish Momentum Emerging

rhboskres

Publish date: Fri, 30 Apr 2021, 05:39 PM

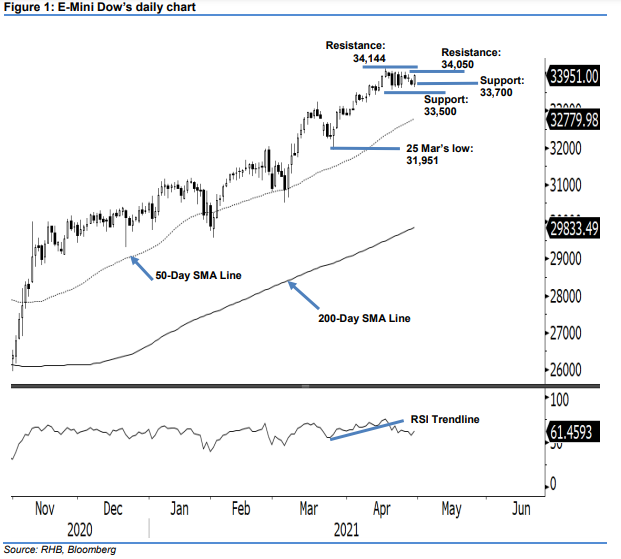

Maintain long positions. The E-Mini Dow saw momentum turn positive yesterday, rising 227 pts to settle at 33,951 pts. The index started Thursday’s session at 33,716 pts and moved sideways for most of the session. It fell to an intraday low of 33,628 pts during the US trading hours. Strong buying interest, later in the session, lifted the index towards a high of 33,979 pts before it was last traded 33,951 pts. The latest price action reaffirms that strong support is marked at the 33,700-pt level. As long as it trades above this level, bullish bias will remain, and the index may retest the 34,050-pt immediate resistance level. As the RSI indicator is curving up, the current bullish momentum may continue in coming sessions. Premised on this, we stick to our positive trading bias.

Maintain long positions. The E-Mini Dow saw momentum turn positive yesterday, rising 227 pts to settle at 33,951 pts. The index started Thursday’s session at 33,716 pts and moved sideways for most of the session. It fell to an intraday low of 33,628 pts during the US trading hours. Strong buying interest, later in the session, lifted the index towards a high of 33,979 pts before it was last traded 33,951 pts. The latest price action reaffirms that strong support is marked at the 33,700-pt level. As long as it trades above this level, bullish bias will remain, and the index may retest the 34,050-pt immediate resistance level. As the RSI indicator is curving up, the current bullish momentum may continue in coming sessions. Premised on this, we stick to our positive trading bias.

We recommend traders stick to the long positions initiated at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, the trailing-stop is placed at 33,700 pts.

The immediate support is established at 33,700 pts, followed by the 33,500-pt round figure. On the upside, the immediate resistance is pegged at the 34,050-pt round figure, followed by 34,144 pts, which was 16 Apr’s high.

Source: RHB Securities Research - 30 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024