FCPO - Gapping Down To Knock Out The Bulls

rhboskres

Publish date: Fri, 30 Apr 2021, 05:42 PM

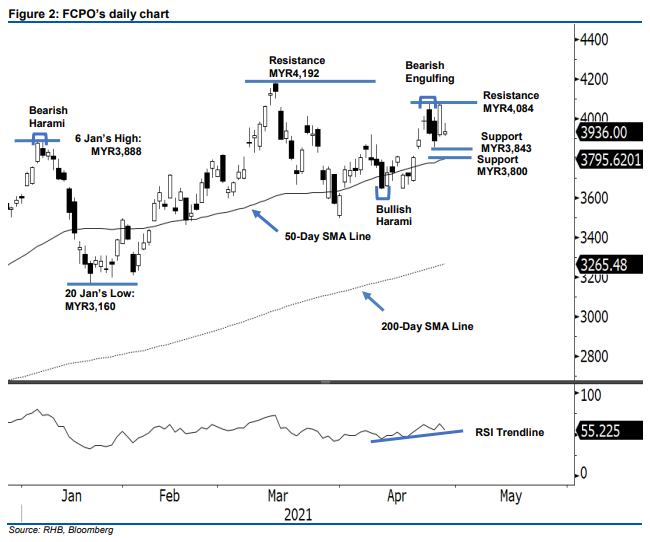

Maintain short positions; stop-loss set lower. Last Tuesday’s strong buying momentum was cancelled by a gap down to close MYR133.00 lower at MYR3,936 on Wednesday – possibly tracking the overnight weakness in the US soybean oil market. This implies that the earlier bullish momentum has turned neutral. The commodity opened lower with a gap down to MYR3,922, before it whipsawed between a low and high of MYR3,913 and MYR3,976 and closed slightly above the opening price, at MYR3,936. The cancellation of bullish momentum has neutralised the immediateterm outlook. However, the medium-term outlook points towards a positive momentum, premised on the commodity continuing to trade above the 50-day SMA line, and the RSI staying above the 50% level. We expect a sideways movement, with the possibility of retesting the MYR3,843 immediate support level in the immediate term. As such, we stick to our negative trading bias, with a stricter stop-loss to reduce risks.

Traders should stick to short positions. We initiated these at the close of 23 Apr, which was MYR3,927. To manage risks, we lowered the stop-loss to the MYR4,000 psychological level.

The support levels stay at MYR3,843 and MYR3,800. Towards the upside, the resistance levels are maintained at MYR4,084, followed by MYR4,192, or 15 Mar’s high.

Source: RHB Securities Research - 30 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024