WTI Crude - Taking a Breather

rhboskres

Publish date: Mon, 03 May 2021, 08:55 AM

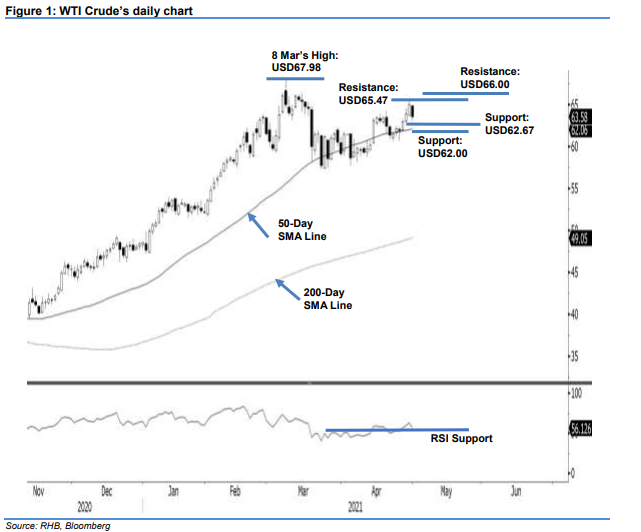

Maintain long positions. The WTI Crude pulled back from April’s high of USD65.47, declining USD1.43 to settle at USD63.58. It started Friday’s session weaker, at USD64.88. After briefly touching the session’s high of USD64.95, it turned south to test the session’s low of USD63.08. It pared some of its losses during the US trading hours to conclude the session at USD63.58. Although Friday’s session saw a bearish candlestick, if the commodity can find a support level between USD62.67 and USD62.00, it will still show a “higher low” pattern. A breach of the USD62.00 mark, or movement below the 50-day SMA line may see the formation of a “lower low” pattern, and signal the start of a correction phase. Until then, we think the recent upward movement is intact, and stick to a positive trading bias.

We recommend traders hold on to the long positions initiated at USD63.86 or the closing level of 28 Apr. To manage risks, a stop-loss is set at USD62.00. The nearest support is marked at 28 Apr’s low of USD62.67, followed by the USD62.00 round figure.

The immediate resistance is pegged to 29 Apr’s high of USD65.47, followed by USD66.00.

Source: RHB Securities Research - 3 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024