Hang Seng Index Futures - Testing the 28,000-Pt Level

rhboskres

Publish date: Tue, 04 May 2021, 09:08 AM

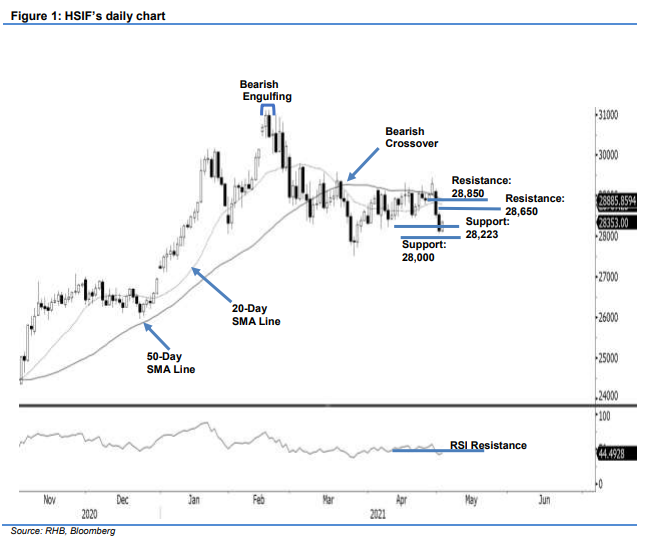

Stop-loss triggered; initiate short positions. The HSIF saw selling pressure accelerate after falling below the 20- day SMA line, declining 397 pts to settle the day session at 28,133 pts. The index initially started Monday’s session at 28,520 pts and rose to the 28,565-pt day high. However, sentiment turned jittery, which saw the HSIF sliding to the day low of 28,053 pts before closing at 28,133 pts. It managed to recoup 220 pts to close at 28,353 pts during the evening session. Since the index is trading below the 20-day SMA line, the moving average may be coupled with the 50-day SMA line turning south – in turn leading to a negative medium-term outlook. If it fails to retain the 28,000-pt level, we may see a deeper correction ahead. Since the stop loss is breached, we change to a negative trading bias.

We closed out the long positions initiated at 29,071 pts, or the closing level of 20 Apr, after the stop loss at 28,400 pts was breached. Conversely, we initiate short positions at the closing level of 3 May’s day session, ie 28,133 pts. For risk-management purposes, the stop-loss threshold is placed at 28,900 pts.

The immediate support is revised to 12 Apr’s low of 28,223 pts, followed by the 28,000-pt psychological level. The immediate resistance is revised to 28,650 pts and followed by the 28,850-pt whole number.

Source: RHB Securities Research - 4 May 2021