E-Mini Dow - Still Maintaining a Bullish Posture

rhboskres

Publish date: Wed, 05 May 2021, 05:23 PM

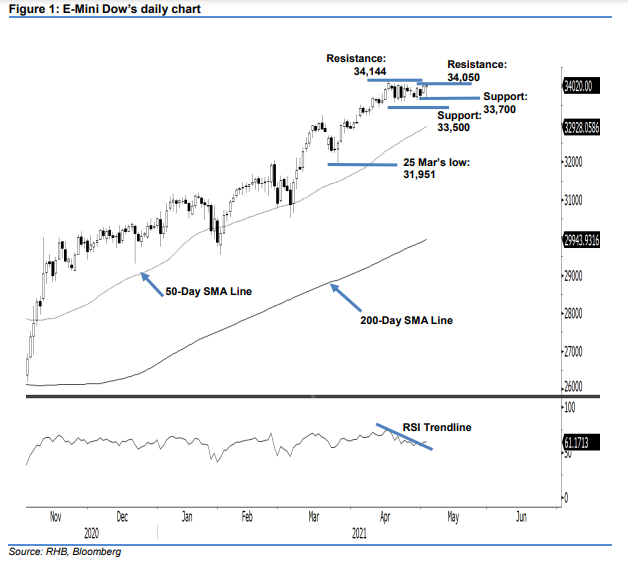

Maintain long positions. The E-Mini Dow experienced a volatile session yesterday, but managed to add 12 pts to settle at 34,020 pts. Initially, it started Tuesday’s session at 33,991 pts, but the bulls went panicked when their European indices peers saw sudden corrections – the index fell to the session low of 33,654 pts. Post US Treasury Secretary Janet Yellen’s speech, the market calmed down and the E-Mini Dow reversed its course and reached the 34,047-pt session high. It closed at 34,020 pts, forming a long lower shadow. The index again tested the strong support of 33,700 pts and, as long as it trades above the crucial support level, sentiment stays positive and may see it move higher to re-test the upside resistances of 34,050 pts and 34,144 pts. The RSI indicator breaking above the trendline indicates the bullish momentum is growing. Hence, the E-Mini Dow retains its uptrend structure and we stick to our positive trading bias.

We recommend traders stick to the long positions initiated at 31,509 pts, or the closing level of 1 Mar. For riskmanagement purposes, the trailing-stop mark is placed at 33,700 pts.

The immediate support remains at 33,700 pts, followed by the 33,500-pt round figure. On the upside, the immediate resistance is eyed at the 34,050-pt round figure and followed by 34,144 pts, or 16 Apr’s high.

Source: RHB Securities Research - 5 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024