Hang Seng Index Futures - Bearish Posture Remains

rhboskres

Publish date: Thu, 06 May 2021, 05:07 PM

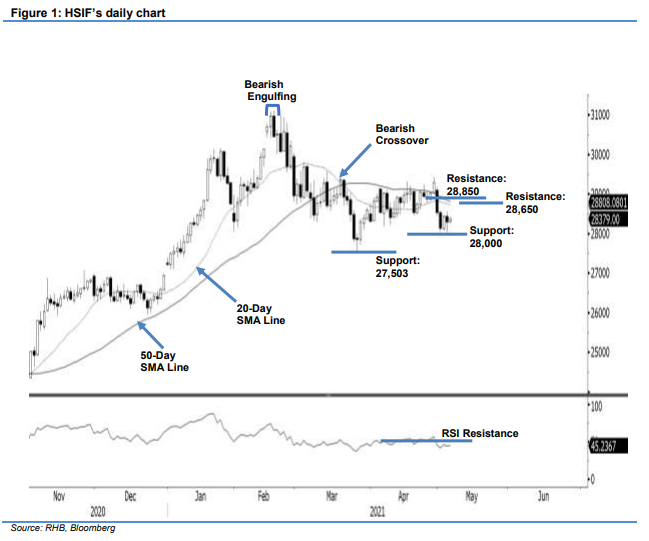

Maintain short positions. While it rebounded from its support level near 28,000 pts – forming a long lower shadow – the HSIF settled the day session at 28,301 pts, which was 143 pts lower than the previous day’s session. It was also observed, during the evening session, that it was last traded at 28,379 pts. As it failed to close above 4 May’s settlement price of 28,444 pts, we deem the reversal pattern as not confirmed, and that bearish sentiment is still in play. Selling pressure may persist in coming sessions, with the 20-day SMA line acting as a stiff overhead resistance. With the RSI trending below the 50% threshold, it is very unlikely that the index will rebound to test the 50-day SMA line in the immediate term. As the index failed to form a “higher high” pattern or meaningful reversal, we are keeping our negative trading bias.

We recommend traders maintain the short positions initiated at the closing level of 3 May’s day session, or 28,133 pts. For risk management, the initial stop-loss is placed at 28,900 pts.

The immediate support is marked at the 28,000-pt psychological level, followed by March’s lowest low of 27,503 pts. The immediate resistance is pegged at 28,650 pts, followed by 28,850 pts.

Source: RHB Securities Research - 6 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024