FKLI - Testing The 200-Day SMA Line Support

rhboskres

Publish date: Thu, 06 May 2021, 05:13 PM

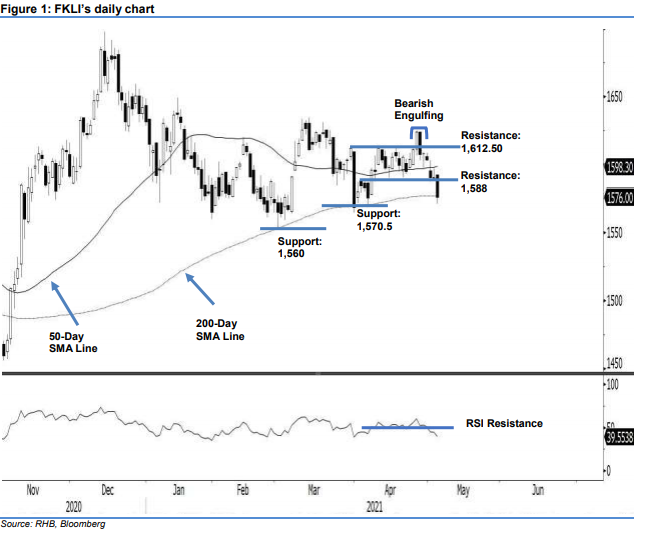

Maintain short positions. The FKLI printed another bearish candlestick where it plunged 14.5 pts – breaching the 1,588-pt level – to close at 1,576 pts. Yesterday, it opened modestly higher at 1,592.5 pts and slid down to touch the day low of 1,571 pts before closing at 1,576 pts. As highlighted in our previous note, the selling pressure heightened after the FKLI fell below the 1,600-pt psychological level. The index is moving on a downward trajectory by displaying a series of “lower low and lower highs”. Although it is touching the strong support of the 200-day SMA line, the current risk-off sentiment may continue to drag the FKLI lower until we see the formation of “a long lower shadow” or bullish reversal pattern. Before that happens, we stick to a negative trading bias.

Traders may maintain short positions. We initiated these at 1,595 pts, ie 30 Apr’s close. For risk-management purposes, the stop-loss threshold is revised to the breakeven level, ie 1,588 pts.

The support level changed at 1,570.5 pts – 6 Apr’s low – and 1,560 pts. Towards the upside, the resistance levels are revised towards the recent support-turned-resistance of 1,588 pts – 8 Apr’s low – and followed by 1,612.5 pts, or 30 Mar’s high.

Source: RHB Securities Research - 6 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024