WTI Crude - Testing the Resistance

rhboskres

Publish date: Thu, 24 Jun 2021, 09:32 AM

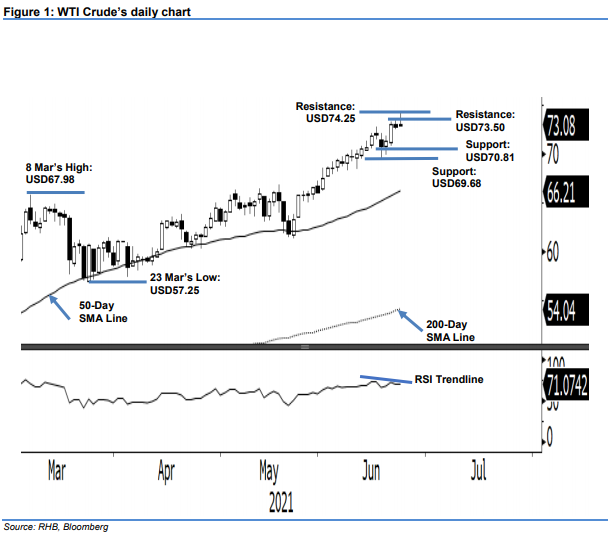

Maintain long positions. The WTI Crude’s upward movement was capped by previous resistance of USD74.00 yesterday despite rising USD0.23 to close at USD73.08. The commodity started the session flat at USD72.91 on Wednesday. After mildly touching the USD72.82 session low, it progressed higher and reached the session high of USD74.25. However, selling pressure emerged above the USD74.00 level, which saw the commodity retrace to close at USD73.08 – albeit still printing a “higher high” bullish structure. As mentioned previously, since the RSI is showing a divergence with the WTI Crude’s price trend, the bullish momentum may not be strong enough to pierce through the resistance pegged at USD74.25 in the immediate term. As long as it consolidates above USD70.81, we believe the momentum may pick up again soon. Keeping this in mind, we retain our positive trading bias.

We recommend traders to maintain their long positions initiated at USD66.05, or the closing level of 24 May. To mitigate the risks, the trailing-stop threshold is fixed at the USD70.78 mark, ie 21 Jun’s low.

The immediate support is marked at USD70.81, or the low of 15 Jun, and followed by USD69.68 – the low of 11 Jun. On the upside, the immediate resistance is sighted at USD73.50, followed by USD74.25 – the high of 23 Jun.

Source: RHB Securities Research - 24 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024