WTI Crude - Climbing Above USD74.00 Again

rhboskres

Publish date: Mon, 28 Jun 2021, 09:02 AM

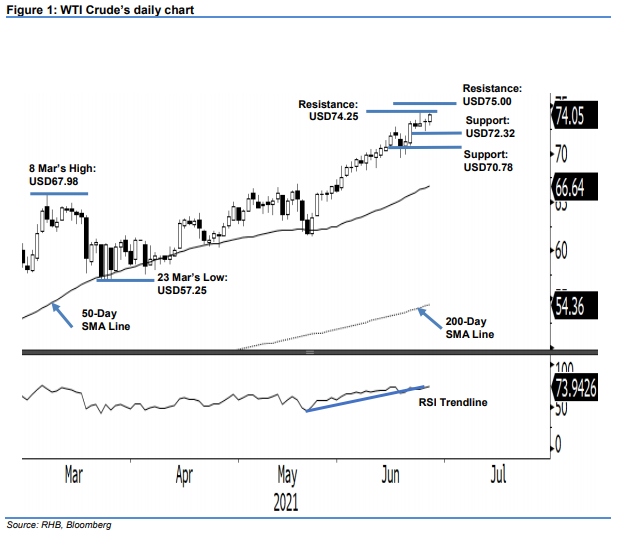

Maintain long positions. The WTI Crude extended its bullish momentum, crossing the USD74.00 level to settle at USD74.05 – recording its fifth consecutive positive week. Last Friday, the commodity started the session flat at USD73.32 and dipped to an intraday low of USD72.85. Strong demand emerged during the US trading session, lifting prices to the intraday high of USD74.18 before closing at USD74.05. As we pointed out previously, the commodity may regain bullish strength after mild consolidation. With the renewed momentum, the black gold may attempt to test the recent high of USD74.25. A breach of this immediate resistance level will send the commodity towards the USD75.00 psychological level. On the downside, if it faces profit-taking pressure in coming sessions, it may find support near the USD72.32 level. As the uptrend is intact, we maintain our positive trading bias.

We recommend traders maintain the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop is adjusted higher to USD72.00.

The immediate support is revised to USD72.32, or the low of 24 Jun, followed by USD70.78 – the low of 21 Jun. On the upside, the immediate resistance is pegged at USD74.25, followed by the USD75.00 psychological level.

Source: RHB Securities Research - 28 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024