FKLI - Consolidating Before the Resistance

rhboskres

Publish date: Mon, 19 Jul 2021, 09:30 AM

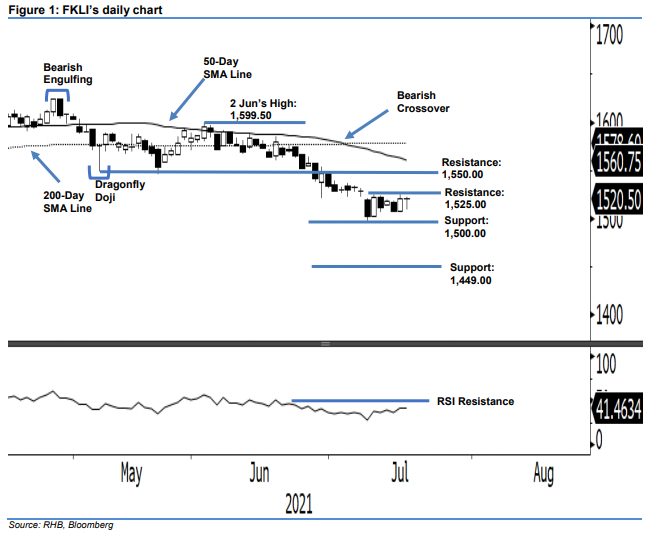

Maintain short positions. Following last Thursday’s strong rebound, bulls took a pause and the FKLI closed with a Doji pattern on neutral sentiment, shedding just 1 pt to end at 1,520 pts last Friday – still below the trailing-stop. On Friday, it opened at 1,521 pts, then touched a high of 1,521.5 pts before falling to the day’s low of 1,509.5 pts. It then gradually rebounded towards the opening price, before heading to a close. The latest price action solidifies the “higher low” pattern formed above the 1,500-pt support. With the RSI trending higher, the recent bullish momentum may follow through in the sessions ahead. The uptrend may strengthen if the RSI breaches above the 50% threshold. If the index fails to do so, it may continue moving sideways. At this juncture, our trading bias remains negative until the trailing-stop is crossed.

We recommend that traders maintain short positions. We initiated these at 1,569.50 pts, or 11 Jun’s close. To mitigate trading risks, we set the trailing-stop at 1,525.00 pts.

The immediate support level is set at 1,500 pts, followed by 1,449 pts or the lowest level in Nov 2020. Meanwhile, the nearest resistance level is at 1,525.00 pts – 9 Jul’s high, and subsequently at 1,550.00 pts or 26 Feb’s low.

Source: RHB Securities Research - 19 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024