E-Mini Dow - The Bullish Momentum Continues

rhboskres

Publish date: Fri, 23 Jul 2021, 06:13 PM

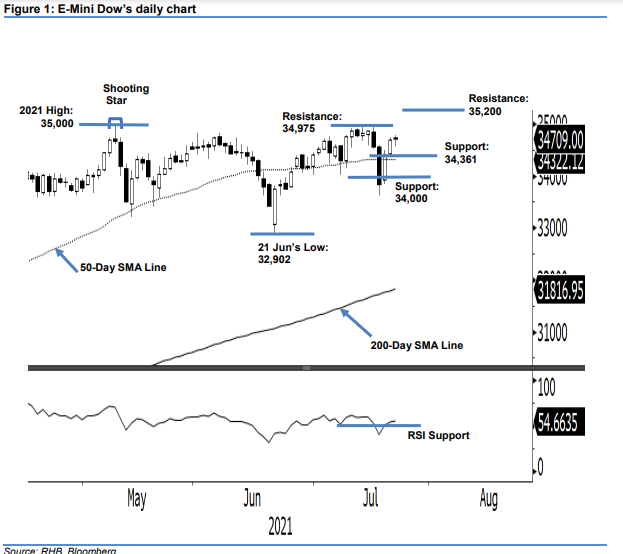

Stop-loss level triggered; initiate long positions. Despite a quiet session, the E-Mini Dow edged higher yesterday, breaching the 34,700-pt level to settle at 34,709 pts. It initially had a strong opening, gapping up to start at 34,733 pts, before moving sideways. At one point, the bears were eager to take profit, which saw the index retracing to the 34,557-pt session low. During the late session, the E-Mini Dow managed to recoup some of the losses to close at 34,709 pts. As mentioned in our previous note, we do expect selling pressure to heighten between 34,700 pts and 34,975 pts, and – indeed – the recent rebound halted at the high of Thursday’s session, ie 34,789 pts. Nevertheless, we expect the index to consolidate sideways while staying above the 50-day SMA line. Since the stop-loss level is breached, we shift to a positive trading bias.

We closed out the short positions initiated at 33,839 pts, or the closing level of 19 Jul, after the stop-loss mark at 34,700 pts was triggered. Conversely, we initiate long position at the closing level of 22 Jul, ie 34,709 pts. To mitigate the trading risks, an initial stop-loss threshold is placed at 34,150 pts – a level below the 50-day SMA line.

The immediate support is revised to 34,361 pts – the low of 21 Jul – and followed by the 34,000-pt round number. On the upside, the nearest resistance level is pegged at 34,975 pts – the high of July – and followed by 35,200 pts, or the uncharted new high.

Source: RHB Securities Research - 23 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024