FCPO - Profit-Taking Continues

rhboskres

Publish date: Fri, 23 Jul 2021, 06:13 PM

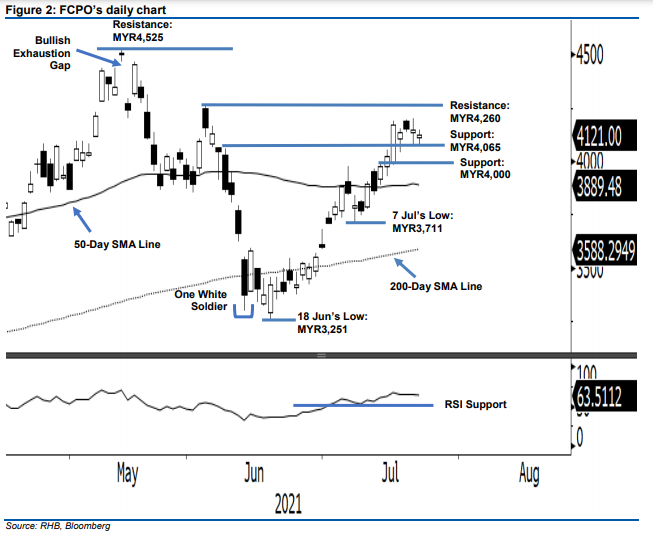

Maintain long positions. The FCPO continued its sideways movement amid profit-taking, falling MYR28.00 to settle at MYR4,121 yesterday. The commodity began Thursday’s session weaker at MYR4,110 and slid to the day’s low of MYR4,074. Buying interest then emerged, and it bounced off in the afternoon session to tap the day’s high of MYR4,145 before closing at MYR4,121. The buying momentum re-emerged near the support level, showing that bulls remain in the driver’s seat – together with the “higher low” structure. With the RSI indicator still trending above 50%, expect the bullish momentum to return after profit-taking activities. If the profit-taking activities continue, the commodity may retrace lower to test the MYR4,000 psychological level. For now, we maintain our bullish trading bias.

We recommend that traders maintain long positions, which were initiated at the close of 13 Jul, or MYR3,977. To manage risks, the trailing-stop is set at MYR4,039.

The immediate support level is at MYR4,065 or 8 Jun’s high, followed by the psychological level of MYR4,000. Towards the upside, the resistance level is set at MYR4,260 (3 Jun’s high) and, subsequently, at MYR4,525 which is 12 May’s high.

Source: RHB Securities Research - 23 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024