COMEX Gold - Struggling Near the Immediate Support

rhboskres

Publish date: Mon, 26 Jul 2021, 09:26 AM

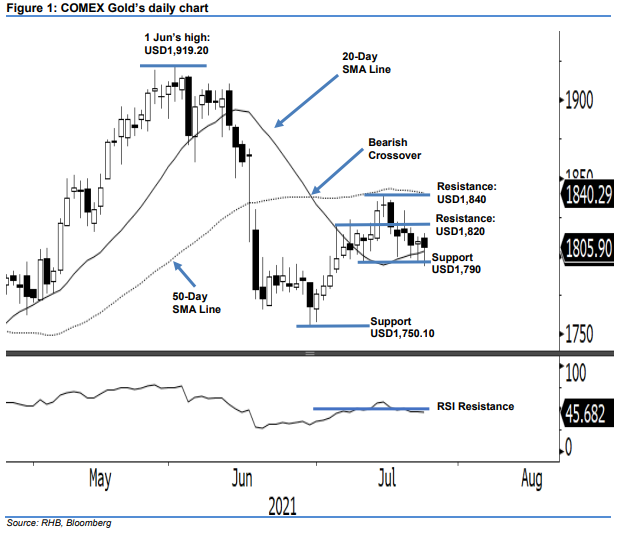

Maintain long positions. The COMEX Gold saw the bulls relentlessly defending the 20-day SMA line last Friday – a critical level to support the uptrend structure. At the end of session, the precious metal fell USD3.30 to settle at USD1,805.90. It initially started the session at USD1,811.50 and then climbed higher to hit the intraday high at USD1,814.50 before the bears dragged it towards the intraday low at USD1,793.10. Strong buying interest during the US session lifted the COMEX Gold higher to recoup some of the losses – it closed at USD1,805.90. Despite the momentum not being strong enough to fully recoup the intraday losses, the 20-day SMA line remains intact. However, the commodity may continue to stick to its sideways consolidation mode, as the RSI is hovering below the 50% threshold, indicating neutral momentum. Unless the negative momentum accelerates and sees the USD1,790 immediate support level giving way, we maintain our positive trading bias.

Traders are advised to stay in long positions initiated at USD1,794.20, ie 6 Jul’s close. To manage the trading risks, the stop-loss threshold is set at USD1,790.

The support levels are fixed at USD1,790 and USD1,750.10, or 29 Jun’s low. Meanwhile, the resistance levels are maintained at USD1,820 and the USD1,840 round figure.

Source: RHB Securities Research - 26 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024