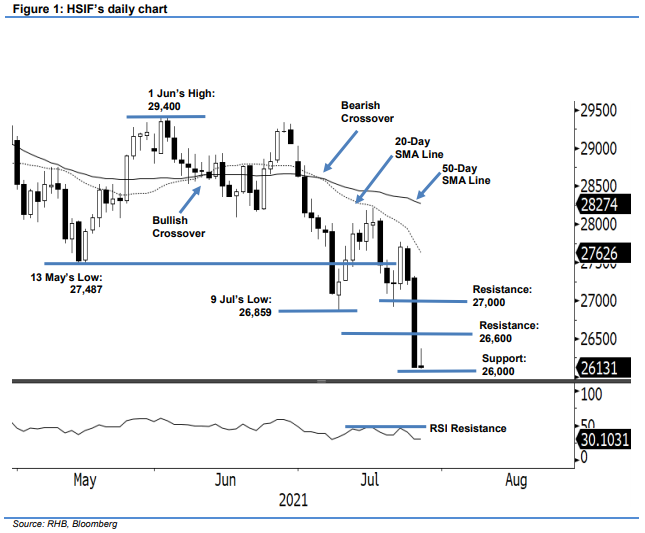

Hang Seng Index Futures - Plunging Towards 26,000 Pts

rhboskres

Publish date: Tue, 27 Jul 2021, 09:37 AM

Maintain short positions. The HSIF became risk-off yesterday, plummeting 1,142 pts to settle the day session at 26,130 pts – erasing 2021’s gains. It opened the Monday session weaker at 26,900 pts. After barely touching the 26,914-pt day high, it turned lower to the 26,112-pt day low and closed at 26,130 pts – recording the worst session since 26 Feb. The evening session saw the HSIF last trade at 26,131 pts. The index may consolidate before the 26,000-pt support level. Breaching this crucial mark may dampen sentiment again, seeing fresh selling. Moving towards Thursday, the July futures contracts are expiring and may see a technical rebound due to rollover activities. We expect the rebound to challenge the resistance pegged at 26,600 pts before the 27,000-pt psychological level. At this juncture, we still see looming bearish sentiment – hence, we stick with our negative trading bias for now.

We recommend traders retain the short positions initiated at 27,469 pts, or the closing level of 19 Jul. To manage the risks, a trailing-stop mark is set at 26,800 pts.

The immediate support is expected at the 26,000-pt round figure, followed by the 25,600-pt whole number. On the upside, the immediate resistance level is revised to the 26,600-pt whole number, followed by the 27,000-pt psychological level.

Source: RHB Securities Research - 27 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024