FKLI - Downward Momentum Continues

rhboskres

Publish date: Wed, 28 Jul 2021, 04:45 PM

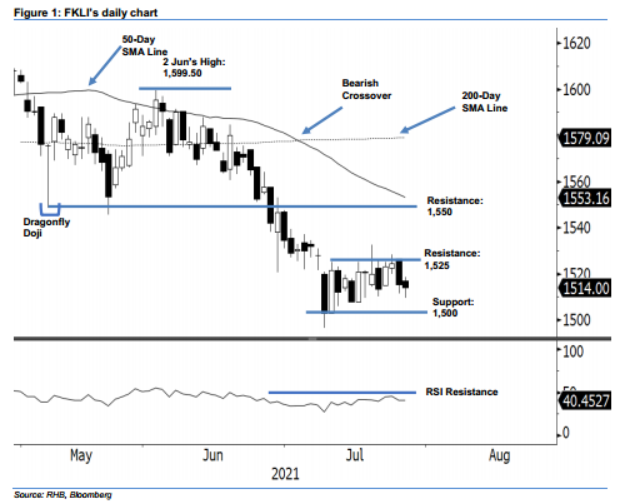

Maintain short positions. After falling on Monday, the FKLI continued its bearish momentum yesterday, falling 1.5 pts to close at 1,514 pts. The index began Tuesday’s session with a gap up at 1,517 pts to tap the intraday high of 1,518.5 pts before it swifly changed direction. Selling pressure persisted throughout the session, which saw the index gradually move downwards to touch the day’s low of 1,509.5 pts before settling at 1,514 pts. Yesterday’s negative movement is in line with the recent downward movement, after the index rejected from immediate resistance of 1,525 pts. Premised on the RSI trending lower, the bearish momentum is expected to persist in the coming sessions. Given the trailing-stop at the immediate resistance remains intact, we stick to our negative trading bias.

Traders are suggested to remain in short positions. We initiated these at 1,569.50 pts, or 11 Jun’s close. To control trading risks, we pegged the trailing-stop level at the nearest resistance level of 1,525 pts.

The immediate support level is unchanged at 1,500 pts or the psychological level, followed by 1,449 pts – the low of Nov 2020. Meanwhile, the resistance levels are placed at 1,525 pts or 9 Jul’s high, and 1,550 pts (26 Feb’s low).

Source: RHB Securities Research - 28 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024