FCPO - Breaching The MYR4,400 Mark

rhboskres

Publish date: Wed, 28 Jul 2021, 04:47 PM

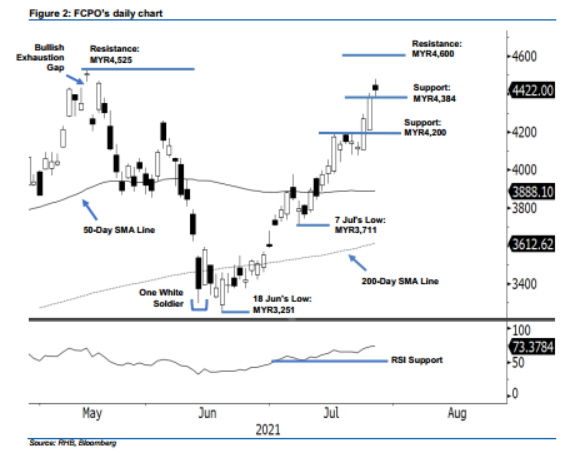

Maintain long positions. The FCPO continued its bullish movement for the third consecutive session, adding MYR39.00 to settle at MYR4,422 yesterday – despite partially paring its intraday gains to close lower than its opening. It began Tuesday’s session with a gap up at MYR4,448. After tapping the intraday’s high of MYR4,480, it gradually moved lower and hit the intraday low of MYR4,384 just before closing at MYR4,422. As the RSI indicator is hovering over the overbought territory of above the 70% level, the bullish momentum may taper for profit taking activities in the coming sessions. Hence, we raise the trailing-stop and peg at the immediate support level of MYR4,384. Until it breaches the immediate support level, we remain our bullish trading bias.

We recommend traders to stay in long positions, which were initiated at the close of 13 Jul, or MYR3,977. To manage risks, the trailing-stop is revised higher to MYR4,384.

The nearest support level is revised to MYR4,384 or 27 Jul’s low, and subsequently, at MYR4,200 (21 Jul’s high). Towards the upside, the resistance levels are set at the MYR4,525 or 12 May’s high and the MYR4,600 round number.

Source: RHB Securities Research - 28 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024