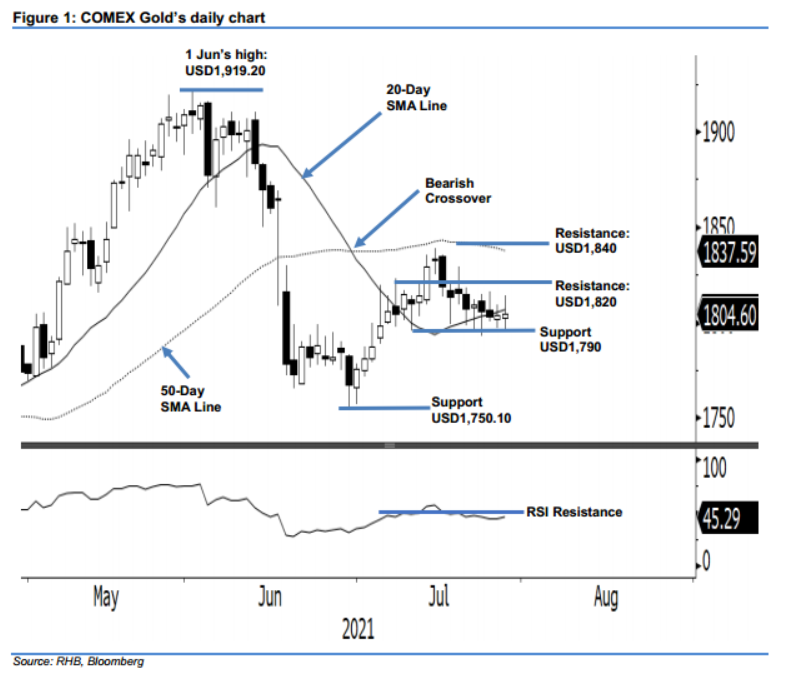

COMEX Gold - Firming Up Its Support Near USD1,790

rhboskres

Publish date: Thu, 29 Jul 2021, 05:42 PM

Maintain long positions. The COMEX Gold saw another quiet session yesterday, marginally rising USD0.60 to close at USD1,804.60 – still moving sideways above the USD1,790 support level. After falling below the 20-day SMA line on Tuesday, it started Wednesday’s session flat at USD1,802.40. The bulls attempted a brief rebound to test the intraday high at USD1,813.90, before sliding to touch the USD1,795.60-day low ahead of its close. The latest price action showed that the bulls were not giving up, and that sentiment remains mildly bullish – if the commodity stays above USD1,790. As the 20-day SMA line is curving up, we may see another attempt by the bulls to move above the moving average. If this happens, the technical set up would be strengthened. Otherwise, sentiment may be dampened if the USD1,790 level gives way. At this juncture, we keep our positive trading bias.

Traders are recommended to keep the long positions initiated at USD1,794.20, or 6 Jul’s close. To mitigate downside risks, the stop-loss threshold is placed at USD1,790.

The immediate support level is fixed at USD1,790, followed by USD1,750.10, or 29 Jun’s low. On the other hand, the immediate resistance level is set at USD1,820, with the higher hurdle at the USD1,840 round figure.

Source: RHB Securities Research - 29 Jul 2021