FCPO - Profit Taking Near The MYR4,400 Level

rhboskres

Publish date: Thu, 29 Jul 2021, 05:50 PM

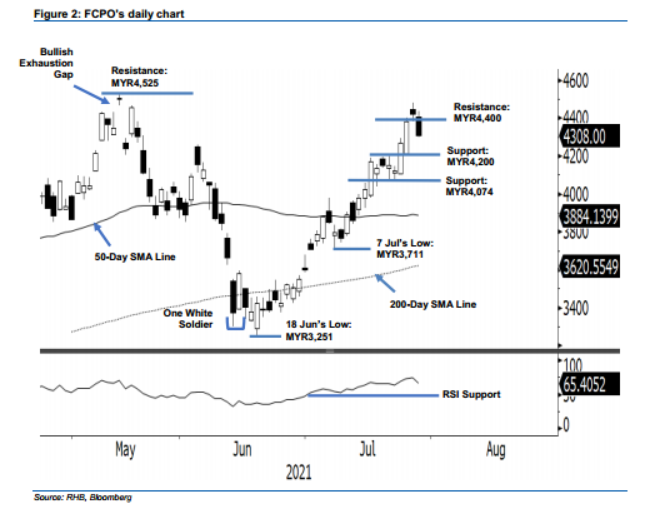

Trailing-stop triggered; initiate short positions. The FCPO failed to hold on to the MYR4,440 level as profit taking activities dragged it MYR114 lower to settle at MYR4,308. Initially, the commodity gapped down to open weaker at MYR4,407. The bulls then staged a quick rebound to test the intraday high at MYR4,437. However, the bears were eager to take profit in the afternoon session, which resulted in the commodity slipping to the day’s low of MYR4,297 before it closed. If profit taking extends, the commodity may test the MYR4,200 or MYR4,074 support level. In the event the bullish momentum returns and reclaims the MYR4,400 territory, sentiment will turn bullish again. Breaching the MYR4,448 level will send the commodity back into an upward trajectory. However, the latest session has breached the trailing-stop. As such, we shift over to a negative trading bias due to profit taking activities.

We closed out the long positions, which were initiated at MYR3,977 or the close of 13 Jul after triggering the trailing stop at MYR4,384. Conversely, we initiate short positions at the closing level of 28 Jul ie MYR4,308. To manage trading risks, an initial stop-loss is placed at MYR4,448.

The nearest support level is revised to MYR4,200 – 21 Jul’s high, followed by MYR4,074 or the low of 22 Jul. Towards the upside, the resistance levels are set at the MYR4,400, the psychological level, and MYR4,525, or 12 May’s high.

Source: RHB Securities Research - 29 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024