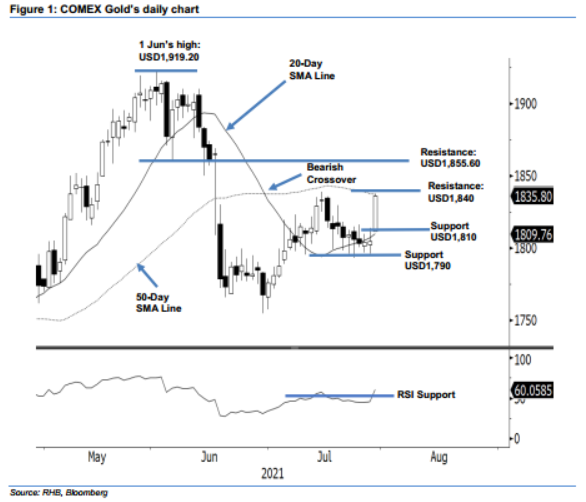

COMEX Gold - Surging Higher to Test the 50-day SMA Line

rhboskres

Publish date: Fri, 30 Jul 2021, 05:15 PM

Maintain long positions. The COMEX Gold saw strong bullish momentum yesterday, surging USD31.20 to close at USD1,835.80 – the best day since 6 May. The commodity had a strong start on Thursday, gapping up USD6.90 to open at USD1,811.50. After touching the USD1,810.90 day low, it progressed higher to test the intraday high at USD1,837.50 before settling in at USD1,835.80 – forming a White Marubozu candlestick. With the bulls in the driver’s seat, we expect positive momentum to follow through in the coming sessions to test the overhead resistance of the 50-day SMA line or the USD1,840 resistance level. Crossing this resistance will boost the momentum towards the USD1,855.60 higher hurdle, or the neckline that formed on 4 Jun. USD1,810 will act as strong support to lever the commodity higher. As of now, we stay with our positive trading bias.

We recommend traders maintain the long positions initiated at USD1,794.20, or 6 Jul’s close. For risk management, the stop-loss threshold is set at USD1,790.

The immediate support level is marked at USD1,810 and followed by a lower one at USD1,790. Conversely, the immediate resistance level is eyed at USD1,840, with the higher hurdle at USD1,855.60, ie the neckline that formed on 4 Jun.

Source: RHB Securities Research - 30 Jul 2021